I doubt any of our readers are too stunned by the CPI studying coming in a bit hotter than anticipated.

The majority of it was in power prices. Meals prices had been, combined with bread and meat, up, whereas eggs and milk had been down. Providers inflation was up barely, whereas shelter prices had been down barely. All in all, with out some black swan occasion, we will start to search for normalization of rates of interest to core inflation.

Most economists and analysts consider that the federal-funds efficient charge goal will maintain regular at its present vary of 5.25% to five.50% With core inflation near the present fed funds charge, many economists are speaking a couple of normalization, or a degree the place the charges are excessive sufficient to manage inflation. If that’s true, it appears to us that the general public must swap the mindset from charge cuts to charge pause at round 5%, as that is extra in step with a more healthy economic system.

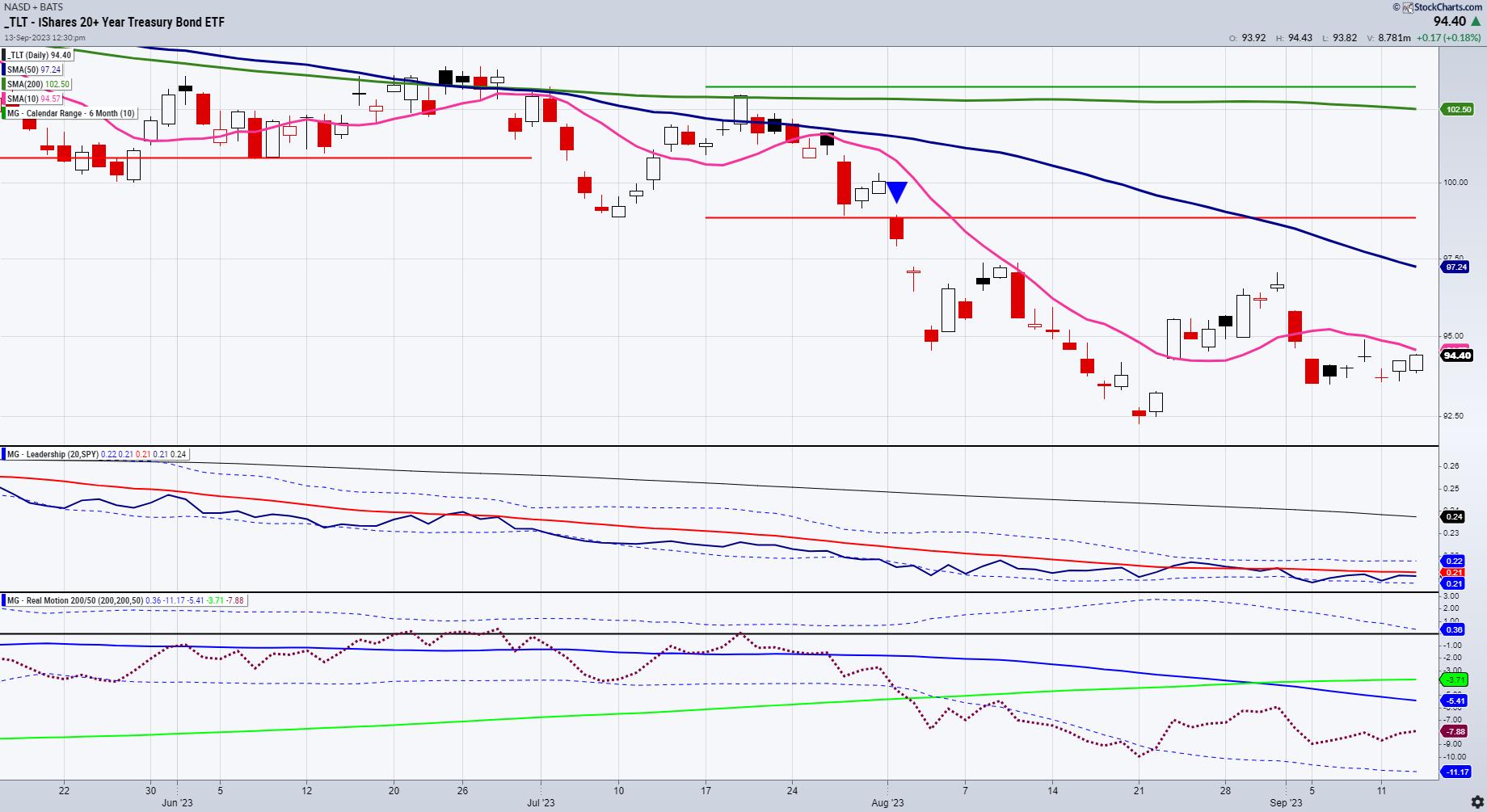

So long as the S&P 500 outperforms lengthy bonds (TLT), danger is on.

Was there injury from the speedy rise in charges? Certain. Nonetheless, we are not looking for charges a lot decrease — nor do we would like them increased. What we would like is an extended length on the present ranges of inflation and rates of interest, with no surprises.

After all, that’s the rub. No shock means wage inflation and strikes, geopolitics, BRICS, mom nature, commerce wars and so forth all should behave. For this reason we’re monitoring the TLTs so rigorously, particularly as they carry out towards the benchmark.

Our Management indicator reveals TLT nonetheless underperforming the SPY. Our Actual Movement indicator reveals a imply reversion in momentum that occurred in late to mid-August. Apparently, it corresponded with a backside within the TLT, which, thus far, is holding up. The momentum section is bearish together with worth.

We wish to see the momentum and worth flatline, neither spiking increased nor going decrease from right here.

On worth, the July 6-month calendar vary low is effectively overhead at 98.80. Ideally, to see an excellent rally within the indices, we would like that normalization. However we do not at all times get what we would like, proper?

Possibly the Fed has…

And perhaps that is the calm earlier than the storm.

That is for instructional functions solely. Buying and selling comes with danger.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Advisor, to study extra.

Should you discover it troublesome to execute the MarketGauge methods or wish to discover how we will do it for you, please e mail Ben Scheibe at Benny@MGAMLLC.com.

“I grew my cash tree and so are you able to!” – Mish Schneider

Comply with Mish on Twitter @marketminute for inventory picks and extra. Comply with Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish discusses AAPL within the wake of the iPhone 15 announcement on Enterprise First AM.

Mish explains tips on how to observe the numbers in oil, fuel, gold, indices, and the greenback daytrading the CPI in this video from CMC Markets.

Mish talks commodities, and the way progress might fall whereas uncooked supplies might run after CPI, on this look on BNN Bloomberg.

On this look on Fox Enterprise’ Making Cash with Charles Payne, Mish and Charles talk about the normalization of charges and the profit, plus shares/ETFs to purchase.

Mish chats about sugar, geopolitics, social unrest and inflation in this video from CNBC Asia.

Mish talks inflation that might result in recession on Singapore Breakfast Radio.

Coming Up:

September 14: Mario Nawfal Twitter Areas

October 29-31: The Cash Present

- S&P 500 (SPY): 440 help, 458 resistance.

- Russell 2000 (IWM): 185 pivotal, 180 help.

- Dow (DIA): 347 pivotal.

- Nasdaq (QQQ): 363 help, over 375 appears to be like higher.

- Regional banks (KRE): 44 pivotal.

- Semiconductors (SMH): 150-161 vary to observe.

- Transportation (IYT): Must get again over 247 to look more healthy.

- Biotechnology (IBB): Compression between 124-130.

- Retail (XRT): 62.90, the July calendar vary low, broke down, together with IYT — 2 adverse indicators and a sign of stress on the patron.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary data and training to 1000’s of people, in addition to to massive monetary establishments and publications akin to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the High Inventory Decide of the 12 months for RealVision.