May you match the fundamentals of non-public finance onto a single index card?

Over ten years in the past, Harold Pollack interviewed Helaine Olen and famously mentioned that the most effective monetary recommendation for most individuals may match onto an index card. Pollack is a professor on the College of Chicago, and whereas he’s most well-known for his views on public coverage, the index card is one in every of his most well-known creations.

I used to be curious: How does it take care of ten years?

Does it nonetheless slot in a world the place individuals shell hundreds on an NFT or cryptocurrency?

What about when rates of interest are the very best it has been in many years?

Desk of Contents

- What’s on the Index Card?

- 1. Max your 401(ok) or equal worker contribution.

- 2. Purchase cheap, well-diversified mutual funds equivalent to Vanguard Goal 20xx funds.

- 3. By no means purchase or promote a person safety.

- 4. Save 20% of your cash.

- 5. Pay your bank card stability in full each month.

- 6. Maximize tax-advantaged financial savings autos like Roth, SEP and 529 accounts.

- 7. Take note of charges. Keep away from actively managed funds.

- 8. Make monetary advisors decide to the fiduciary customary.

- 9. Promote social insurance coverage packages to assist individuals when issues go unsuitable.

- What does the Index Card Do Nicely?

- What’s the Index Card Lacking?

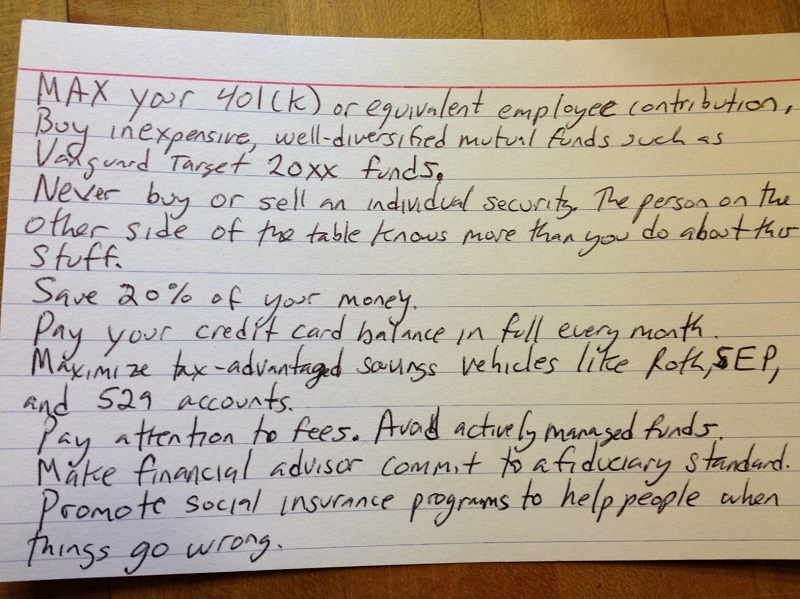

What’s on the Index Card?

First, the 9 pillars of non-public funds are written on the index card itself.

- Max your 401(ok) or equal worker contribution.

- Purchase cheap, well-diversified mutual funds equivalent to Vanguard Goal 20xx funds.

- By no means purchase or promote a person safety. The particular person on the opposite facet of the desk is aware of greater than you do about these items.

- Save 20% of your cash.

- Pay your bank card stability in full each month.

- Maximize tax-advantaged financial savings autos like Roth, SEP, and 529 accounts.

- Take note of charges. Keep away from actively managed funds.

- Make monetary advisors decide to the fiduciary customary.

- Promote social insurance coverage packages to assist individuals when issues go unsuitable.

Earlier than we dig too deep into the criticism, I need to acknowledge that this seems to be a listing of basic guidelines of thumb that ought to provide you with steerage on what’s finest. It’s not an all-inclusive technique.

For instance, an important step anybody can take is to give you a monetary plan. You don’t must go to a monetary planner to create it, however you do must have an thought of what you want to accomplish and by when.

Additionally, Pollack went on to put in writing a ebook with Olen about this card (The Index Card: Why Private Finance Doesn’t Should Be Sophisticated), and solely in one thing of that size are you able to get into the nuance of every line.

1. Max your 401(ok) or equal worker contribution.

Tax-deferred retirement accounts are improbable investing autos and so long as it matches your long-term plans, you need to contribute as a lot as you’ll be able to, as early as you’ll be able to. By contributing early, you enable the ability of compounding to take maintain.

I don’t consider you could attempt to hit the 401(ok)’s annual contribution restrict in case you have competing financial savings objectives. So long as you’re maximizing what you’ll be able to contribute, you’re properly in your method.

This pairs with its shut cousin, #6 Maximize tax-advantaged financial savings autos like Roth, SEP, and 529 accounts, since you need to make the most of each due to the tax advantages.

2. Purchase cheap, well-diversified mutual funds equivalent to Vanguard Goal 20xx funds.

Vanguard has made a trillion-dollar enterprise out of promoting cheap, well-diversified mutual and index funds. Their Goal Retirement funds are merely a set of these funds. Over time, because the goal date nears, the allocation adjustments to suit the goal age.

There’s no purpose you could purchase an costly, non-well-diversified mutual fund so this recommendation is fairly secure to observe. 🤣

That mentioned, there are costly mutual funds they usually exist as a result of:

- These buyers didn’t have every other choices

- These buyers have been unaware options exist

For instance, check out Putnam BDC Earnings ETF (PBDC). It’s an exchange-traded fund that invests “in firms providing engaging earnings to public buyers via non-public market publicity.” It has a complete annual fund working bills of 10.61%!

I’m not throwing any shade at this ETF. There’s some investor on the market who would profit from proudly owning this ETF however most don’t. It’s a distinct segment ETF with very excessive charges, the alternative of this sage recommendation.

You’re higher off going with a goal date fund or perhaps a easy three-fund portfolio.

3. By no means purchase or promote a person safety.

The particular person on the opposite facet of the desk is aware of greater than you do about these items.

You could be a very profitable investor by simply investing in ETFs and mutual funds. You may get market returns, get pleasure from your life, and by no means purchase a person safety.

That mentioned, I dislike the notion that you simply shouldn’t do that as a result of different “particular person” is aware of greater than you about these items. I’d add nuance to say that there’s no particular person on the opposite facet of the desk, it’s the market and the market doesn’t know something. The market is the consensus of each participant and it’s additionally irrational.

However missing information or experience isn’t an excellent purpose to keep away from doing one thing. For those who care sufficient, it is best to attempt to be taught extra and achieve information. You should still come to the conclusion that you simply don’t want to purchase a person safety.

You additionally must keep away from the Dunning-Kruger impact if you be taught a bit of bit and overestimate your experience. There are lots of buyers who benefited from Tesla’s run and now really feel they’re nice inventory pickers!

(Lastly, this consists of every kind of securities like bitcoin, dogecoin, NFTs, and so on… you don’t want these to prosper!)

4. Save 20% of your cash.

Sure, we may amend it to say “Save at the very least 20% of your cash.”

You would additionally add that this may embrace what you pay down in the direction of present high-interest debt. When you’ve got bank card debt, you need to be decreasing that as a lot as doable. Saving 20% right into a financial savings account whereas paying double-digit bank card curiosity is counterproductive.

When you’re at it, don’t pay greater than 30% for housing. (Cash ratios are very helpful reminders!)

5. Pay your bank card stability in full each month.

100% strong gold recommendation. There’s no purpose to hold a stability until you haven’t any different alternative.

Some individuals consider that you could carry a stability to construct up credit score, however that’s not true. Your bank card experiences your assertion stability at any time when it closes for the month. For those who pay it all the way down to $0 (at all times!), the corporate nonetheless experiences the stability to the bureaus so that you get “credit score” for utilization and good habits.

Some consultants recommend you pay it off early so the quantity reported is decrease, thus decreasing your credit score utilization. That’s good recommendation too, although it’s unclear how a lot of a profit there may be and for a way lengthy.

Once you carry a bank card stability from month to month, you lose the grace interval. For those who begin every cycle with a $0 stability, you don’t pay curiosity in your purchases that month. That’s the grace interval. For those who carry a stability, there’s no grace interval. Curiosity accrues instantly.

6. Maximize tax-advantaged financial savings autos like Roth, SEP and 529 accounts.

Taxes are one of many largest bills you’ll pay annually and when you can cut back it in a roundabout way, improbable!

If you’re eligible for a Roth IRA, I’d advocate contributing as a lot as you’ll be able to. The quantity you’ll be able to contribute relies in your modified adjusted gross earnings. For those who earn an excessive amount of, you’ll be able to’t contribute as a lot. The contribution restrict for a Roth IRA in 2023 is $6,500 and the earnings phase-out goes from $138,000 – $153,000 (single filers).

As for the 529, the foundations are altering on account of the SECURE 2.0 Act and the 529 is extra versatile than earlier than. The areas you need to use the 529 will develop to incorporate Ok-12 bills and you may even rollover a few of it to a Roth IRA. The 529 is even higher than when Pollack first steered it on this line.

7. Take note of charges. Keep away from actively managed funds.

For those who adopted #2, investing with goal date retirement funds or simply low-cost mutual funds, then this one is redundant in terms of funding choices.

That mentioned, “Take note of charges” is sound recommendation throughout. Actively managed funds are usually dangerous however you could take note of different charges too. For those who work with a monetary advisor, do you pay them for his or her time or do you pay a share of property beneath administration? (you solely want payment solely advisors!!!)

Are they paid a fee for the services they advocate?

Observe the cash.

8. Make monetary advisors decide to the fiduciary customary.

A fiduciary customary is when the advisor should put your pursuits above their very own.

There’s additionally a weaker customary referred to as a suitability customary, which suggests the recommendation have to be appropriate in your wants.

Funding advisors should observe a fiduciary customary, whereas a dealer solely wants to suit a suitability customary.

For those who’re going to work with an advisor, affirm they’re a fiduciary earlier than shifting ahead. Nice recommendation right here.

9. Promote social insurance coverage packages to assist individuals when issues go unsuitable.

That is good recommendation however ought to be expanded to make sure that you’re personally insured for all of the liabilities in life.

For those who personal a house, ensure you have householders and flood insurance coverage (in case you have a mortgage, the lender would require this). For those who personal a automobile, ensure you have sufficient auto insurance coverage (states all require this). When you’ve got a physique, you want medical health insurance, dental, and imaginative and prescient.

When you’ve got different money owed or monetary obligations, equivalent to youngsters, you then’ll need to ensure you have sufficient life insurance coverage. This manner, within the occasion of your dying, they’re taken care of.

Lastly, it might be sensible to get umbrella insurance coverage to cowl all the things else.

What does the Index Card Do Nicely?

General, I feel the index card is nice. It accommodates lots of fundamental private finance recommendation that everybody ought to be following.

The fundamentals are straightforward however generally we want a reminder. The each day could be overwhelming, particularly when you work a demanding job, and so it’s straightforward to neglect the fundamentals.

The index card works finest for people who find themselves within the first quarter of their private finance growth. This isn’t primarily based on age, simply in your training and consciousness of non-public finance ideas. If you’re new to managing your cash, the index card is an efficient first step.

It’s necessary to notice that the cardboard was meant to seize the fundamentals that apply to as many individuals as doable. On that mission, it has delivered. However the danger is that the cardboard is too fundamental. We all know we should always save extra, we shouldn’t carry bank card debt, and we should always spend money on low-cost mutual funds.

The cardboard additionally identifies a number of darkish corners of the monetary world that it is best to keep away from. A goal date fund is nice, particular person securities are largely pointless, and also you desire a fiduciary. It’s straightforward to go down the rabbit gap of funding merchandise when you’ll be able to follow the fundamentals, get lots of the good thing about investing, and reside the remainder of your life.

For those who observe all the things it says, you’ll be in good condition, but it surely’s not all-encompassing and you continue to must do some additional homework.

Now that we’ve handed out the roses, what are the thorns?

What’s the Index Card Lacking?

The largest miss is that it doesn’t discuss your monetary plan. What are your objectives? When do you need to obtain them? Must you alter these objectives and the schedule primarily based in your means? If this card is a listing of ways, having an total technique (in a monetary plan) would assist inform lots of the selections you make together with your cash.

You don’t should work with a monetary advisor to give you a monetary plan, however one will help. You can begin by constructing your individual monetary plan after which carry it to somebody who may give it a glance. Armed with a plan, you’ll be able to decide how a lot you ought to be saving to the assorted tax advantaged accounts. You don’t need to save an excessive amount of solely to have to drag it out to fund a necessity.

Subsequent, it doesn’t actually contact on something for households, retirees, or anybody else who could have handed via a number of of life’s main milestones. It doesn’t have a lot recommendation for people who find themselves about to retire or about to purchase a house. I get that these could also be too particular to suit on a single card, so I don’t fault the cardboard for not together with them.

It’s lacking something notable about insurance coverage and easy methods to be adequately protected. We touched on it in our critique of #9, which was about selling social packages. It additionally doesn’t embrace something about charitable giving too, although I suppose that might additionally fall into #9’s bucket.

Lastly, we don’t have any point out of property planning, which I consider is necessary, particularly as you grow old. Property planning and finish of life planning could be uncomfortable to consider however when you don’t do it, your loved ones is pressured to guess at what you need.

I view the index card as an excellent reminder of fine private finance hygiene, like brushing your tooth within the morning and flossing each night time. It’s by no means dangerous to overview the fundamentals however simply understand it’s not

What do you consider the index card? What does it get proper? What could it’s lacking?