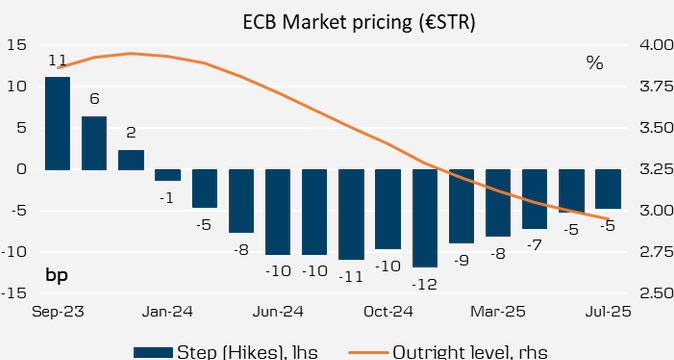

We woke as much as the information that the cash markets at the moment are pricing in a full 25 bps hike within the fee by the ECB by the top of the yr. We’re speaking right here about OTC swaps (EONIA) and for now – because the futures market is just not open on the time of writing – we can’t be extra particular in regards to the month the markets are pricing in, however it’s most certainly December. We are able to, nevertheless, present you yesterday’s state of affairs, the place the derivatives market was pricing in a complete of 66 bps down for 2024, with a return to the CURRENT deposit fee (3.75%, not the official 4.25%) solely in June, and the yr closing – based on present expectations – at 3.50% (additionally on the deposit fee). In brief, in 15 months from now the ECB fee is anticipated to fall by 0.25%. Not so much. Greater for Longer.

There’s a slight likelihood of a hike at subsequent week’s assembly: odds stand at 40% which signifies that such a transfer could be perceived as a shock resulting in a good quick time period rise within the EUR. Lagarde and firm don’t appear to have any curiosity in offering such a shock in the meanwhile as a result of regardless of sticky core inflation, different financial indicators are fairly unfavorable. Maybe they’ll attempt to play on different elements such because the untimely finish of the extraordinary quantitative easing programme PEPP or the change in minimal reserve margins required from the banking sector. For now, let’s deal with the EURUSD.

TECHNICAL ANALYSIS

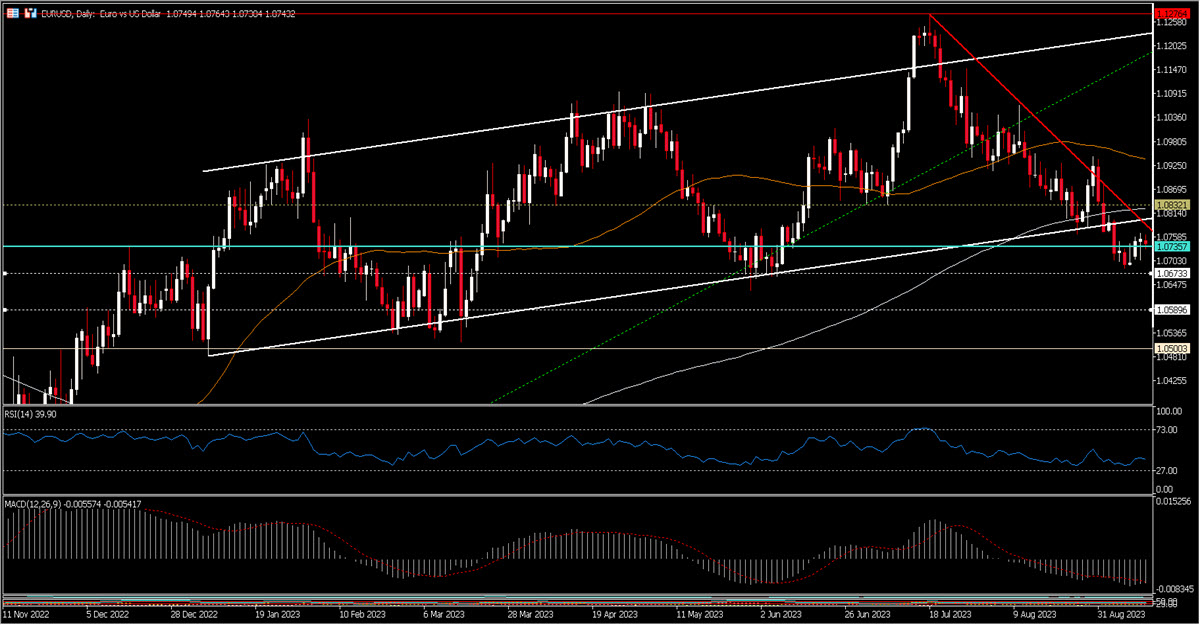

The technical state of affairs of the EURUSD has deteriorated persistently within the house of a few months, from 1.1275 touched on 18/07 to the present 1.0746 (-4.69%): certainly, this pair seems worse off than the Cable we analysed yesterday, being clearly beneath the 2 long-term shifting averages we’re used to utilizing (50d and 200d) and in addition beneath the marginally bullish channel that has guided costs for the reason that starting of the yr (however nonetheless inside the margin of error).

The 1.0735 space is essential and powerful, having been the bottom (assist) within the publish covid interval, from January to Could 2020, earlier than a rally within the 1.2270 space. But it surely was undoubtedly a unique financial context. We get on the week earlier than the ECB additionally very near the downtrend of the final 2 months, which now passes via 1.0845. Given additionally the traditional persistence of foreign money tendencies, we have a tendency in direction of a continuation of the bearish motion within the quick time period (at the least till subsequent week’s assembly), with helps within the space of 1.0675 after which 1.0590. 1.05 can also be a really sturdy space.

What is going to occur on the day of the assembly is a binary end result and a attainable shock from the ECB will give quick time period wings to the EURUSD and doubtless lead it to check the bearish purple line. However let’s not neglect that in the meanwhile the long-term expectations between the US and European central banks don’t differ that a lot (near the top of the tightening cycle) and subsequently different motivations will most likely clarify the longer term motion of this elementary pair.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication incorporates, or must be thought of as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info offered is gathered from respected sources and any info containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the data offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.