FedEx Corp is an American multinational conglomerate holding firm which engages within the provision of transportation and supply companies (FedEx Categorical), small-package floor supply companies (FedEx Floor), freight transportation companies to companies and residences (FedEx Freight), gross sales, advertising and marketing, data expertise, communications, clients service and back-office features in addition to different working segments (FedEx Providers). The corporate is scheduled to report its earnings for fiscal quarter ending Aug 2023 on 20th September (Wednesday), after market shut.

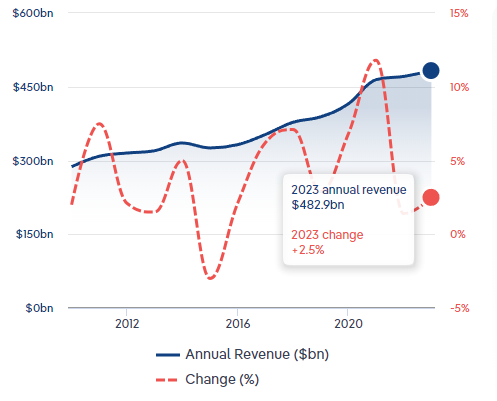

Normally, international courier & supply companies have undergone a declined CAGR at -5% over the previous 5 years. The business bagged a good-looking annual income over $460B (+11.8% (y/y)) in 2021, when e-commerce exercise boomed throughout the peak of the pandemic. Nonetheless, as transport quantity declined later, coupled with rising oil costs and operational prices and so on., common revenue for these courier and supply companies firms is anticipated to succumb to its lowest level since 2009.

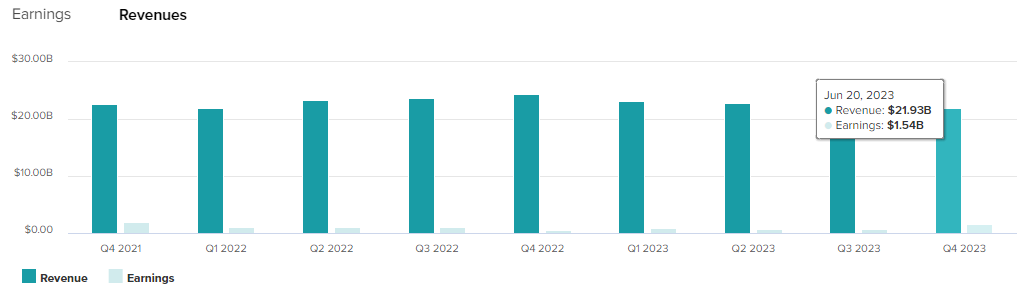

FedEx: Revenues & Earnings (After Deduction of Tax and Bills). Supply: Tipranks

FedEx gross sales income has declined for 4 consecutive quarters, to the newest at $21.93B. In the identical interval final 12 months, the corporate’s gross sales income hit $24.39B. Regardless of working margin at 8.1% which is under that within the earlier 12 months (9.2%), it was nonetheless considered the strongest all through the fiscal 12 months. The welcoming result’s as a result of firm’s stable expense administration in addition to its DRIVE transformation which includes efforts in bettering the general effectivity when it comes to decide ups, transports, and package deal deliveries. Headwinds similar to price inflation and demand weak point are partially offset by price discount actions and its native package deal yield enchancment.

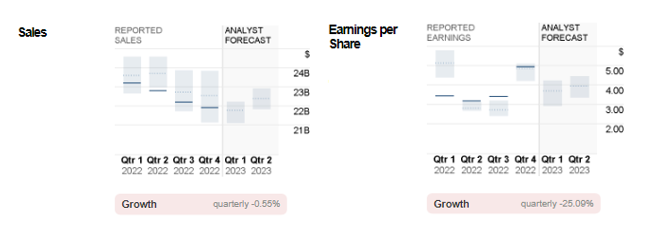

FedEx: Gross sales Income & EPS versus Analyst Forecast. Supply: CNN Enterprise

Consensus estimates for gross sales income of FedEx stay flat at $21.8B, consistent with the administration outlook. Quite the opposite, EPS is anticipated to hit $3.70, down over -25% from earlier quarter. In the identical interval final 12 months, its EPS was $3.44.

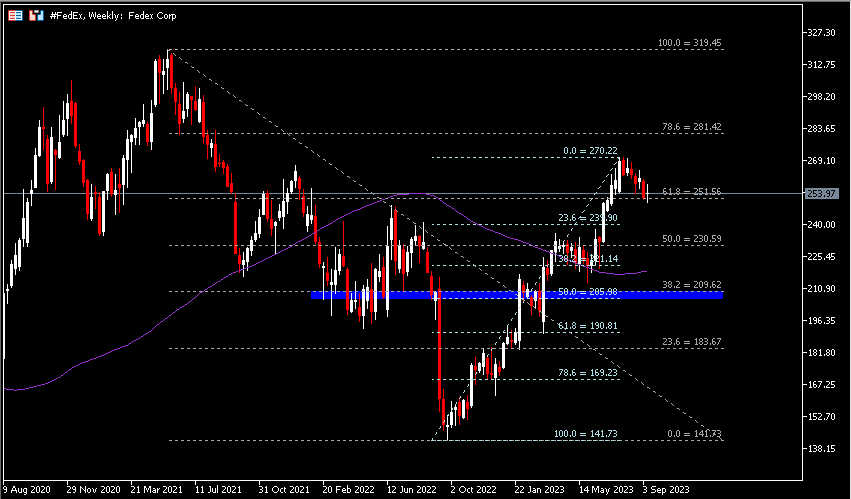

Technical Evaluation:

The #FedEx share value recovered over 60% of the losses between Might 2021 to September 2022, since gaining floor above 141 (a brand new low since late June 2020). Latest value motion has retraced in direction of assist $251.50, leaving a session excessive at $270.22. If the asset breaks under the stated assist, the subsequent degree to deal with is $239.90, adopted by $230.50. However, a bullish transfer above $270.22 would point out continuation of the bullish development, with $281.40 and the psychological degree $300 in focus.

Click on right here to entry our Financial Calendar

Larince Zhang

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature includes a excessive degree of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made based mostly on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.