I not too long ago watched a documentary about Invoice Gates on Netflix and the factor that caught with me probably the most from it was that he didn’t develop into one of many wealthiest folks on this planet by means of luck or inheriting enormous sums of cash. He actually reads like 8 books whereas touring, he can learn 150 pages an hour, and he ENJOYS studying. One among his shut buddies mentioned “Invoice all the time is aware of extra about any topic than the individual he’s speaking to about it”. What does this need to do with buying and selling? Every thing…

The important thing to buying and selling success is growing your self right into a worthwhile dealer by studying to commerce correctly and being persistently disciplined to comply with an efficient buying and selling routine till it turns into a behavior.

Right here’s what it’s essential learn about buying and selling routines: Buying and selling routines are the true key to success available in the market. There’s no magic indicator or algorithmic buying and selling robotic that’s going to simply make you a worthwhile dealer. Similar to Invoice Gate’s routine every and on a regular basis over the course of years, led him to insane monetary success, so can your buying and selling routine. Nevertheless, when you have no routine or the unsuitable routine, you’ll by no means develop into a profitable dealer. May Invoice Gates have laid round watching T.V. consuming Cheetos all day as a substitute of studying the whole lot he might get his palms on about enterprise and programming? Certain. And you’ll by no means know who Invoice Gates was if he had carried out that.

There’s a “fireplace” within Invoice Gates; a want to be taught, to develop, to be extra, that gave the impression to be half innate and half developed by means of his childhood. I can not present this for you, it’s essential to develop it if you happen to don’t have it. However, I CAN provide the framework, the “keys” to the “kingdom” so to talk, however it’s important to be within the correct buying and selling mindset to have the ability to ‘flip’ the important thing. So, if you happen to’re prepared, learn on and be taught concerning the day by day buying and selling routine that has labored for me for the final 10+ years available in the market….

The Fundamental Components of My Every day Buying and selling Routine

- My buying and selling routine includes interacting with the market FAR lower than many different merchants. This works for me and I firmly imagine that it’ll be just right for you for the next causes: Much less stress, Much less time to mess up your trades by over-involvement, low commerce frequency, instills self-discipline, you management solely your self and don’t attempt to management the market.

- My total strategy is to deal with end-of-day information, which implies I deal with the day by day chart time frames and I’ll sometimes wait till the market closes every day to essentially sit down and take an in depth have a look at the markets in my watch record. That is what I name a half time buying and selling routine and never solely does it have the benefit of much less screen-time (so you are able to do different issues) however the actual fact that you simply’re spending much less time in entrance of the charts really will enhance your buying and selling efficiency over the long-term.

- I take a weekly view first: I take a look at the weekly chart time frames, attract the important thing ranges, get a really feel for the near-term and long-term tendencies and make a remark of any apparent / giant worth motion reversal indicators.

- Subsequent, we’re trying on the day by day chart timeframe. We’re primarily in search of key ranges of assist and resistance, the present and up to date market situations: Trending or sideways? And final however not least, we’re trying on the PRICE ACTION; any indicators which will have shaped close to the important thing ranges? Any indicators shaped after a pull again to a stage? Be aware: Ranges will be horizontal ranges of assist or resistance or EMA – exponential transferring averages and even 50% retrace ranges.

- Now, since that is only a weblog put up, I’ve to “gloss” over a number of the extra detailed matters like cash administration, buying and selling psychology, cease loss placement, and many others, however you possibly can comply with the hyperlinks I simply offered to be taught a bit extra and naturally these matters are mentioned rather more totally in my skilled buying and selling course.

- What’s the GLUE of all of this? Of my whole buying and selling course of? Easy. It’s routine – self-discipline – behavior or RDH. Let me clarify this to you (it’s crucial) – Bear in mind my point out of Invoice Gates earlier? Invoice Gates most likely has higher habits than you (or me to be sincere), Warren Buffet too. The elite of the world, these women and men who’ve amassed giant fortunes or in any other case succeed at their craft, obtained to that time by means of Routines that took Self-discipline which became Habits. The dedication is unreal, however truthfully, that’s what it takes. Invoice Gates doesn’t learn so many books as a result of he hates it, he does it as a result of he genuinely loves it! So, you actually should love buying and selling and it’s essential to love the routine and self-discipline if you happen to hope to show them into correct buying and selling habits. Correct buying and selling habits are what carry you wealth within the markets, there is no such thing as a straightforward means or short-cut apart from TRULY loving the method. And keep in mind, I can present you my course of, the one which has labored for me, but it surely’s as much as you to LOVE it, to be passionate sufficient concerning the course of to make it work!

My Every day Buying and selling Course of: Chart Evaluation and Commerce Execution

The primary main chart facet of my buying and selling routine is taking a “fowl’s eye” view of the markets on my watch record. That often means beginning with the weekly chart timeframe and giving it a very good once-over. I’m primarily in search of key ranges available in the market, main turning factors, tendencies and areas of consolidation to make be aware of. I all the time mark the important thing ranges on the weekly chart first, right here’s an instance:

Subsequent, I’ll drop all the way down to a day by day chart timeframe and start analyzing it in a really comparable means. The important thing ranges from the weekly could should be adjusted a bit on the day by day, relying on the value motion or it’s possible you’ll want to attract in extra ranges:

Now, I’m analyzing the near-term market situations to determine which path is the most effective to commerce in and what close by ranges / areas are crucial to look at. I’ll typically use a transferring common right here, just like the 21 EMA or comparable, to assist see the near-term development and momentum. Additionally, you will wish to be taught to determine intervals of Increased Highs / Increased Lows and Decrease Highs / Decrease Lows, which you’ll be able to be taught extra about it in my article on easy methods to determine trending markets.

Final, however actually not least, I’m in search of worth motion indicators / potential trades. I’m particularly in search of “clear and apparent” indicators that line-up with ranges on the chart, in different phrases, which have confluence.

- What you noticed above within the charts is a short overview of my weekly / day by day chart evaluation routine that I do for all of the markets in my watchlist. In case you don’t have a watch record, it is best to learn my article on creating market watch lists for extra.

- Markets undergo phases. Research the markets you want probably the most in your watch lists and you’ll get to know them, get intimate with them. In case you see some or most of them are in unhealthy buying and selling phases, or sideways consolidation that’s uneven, simply look at them and stroll away or don’t even test them for just a few days. The very best buying and selling phases or situations are trending or when markets are buying and selling in very outlined and bigger buying and selling ranges.

- I can not pound this into your head sufficient: MOST TRADERS LOSE BECAUSE THEY LOOK AT THE CHARTS TOO DAMN MUCH! The market shouldn’t be meant to be a on line casino so don’t deal with it as one. Don’t get hooked on it! View and deal with the market as a means so that you can present how deliberate, expert and disciplined you will be and you’ll get rewarded handsomely for doing so.

How I Discover a Commerce, Set it Up and Execute It

Now, upon getting carried out the above steps, let’s say you notice a possible commerce. Right here is how I’ll set it up with the entry, cease loss and revenue goal placement…

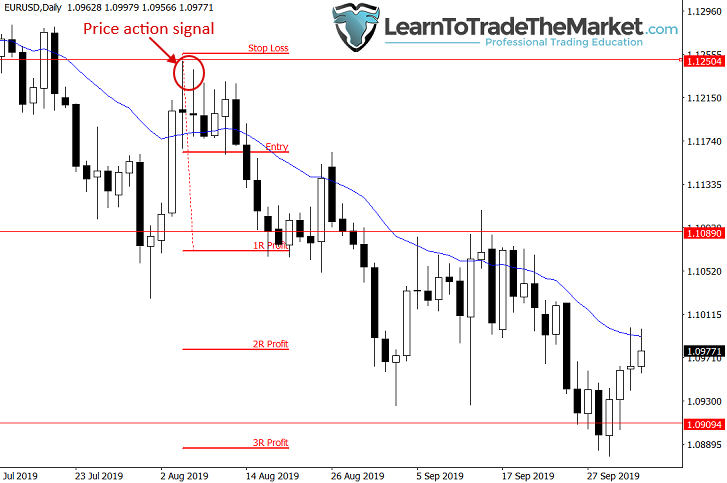

- Discover the “worth motion sign” within the chart beneath, this was technically a bearish tailed bar, adopted by a pin bar sign that was additionally an inside bar inside that bearish tailed bar. Worth consolidated for just a few days earlier than finally breaking decrease with the present downtrend.

- Worth had pulled again to resistance on the 21 EMA (blue line) and the 1.1250 horizontal stage, so we had a number of factors of confluence: stage and development.

- Merchants might have netted 2R revenue from this commerce had they held on to it for 3-4 weeks after entry. Because of this I all the time preach set and neglect buying and selling!

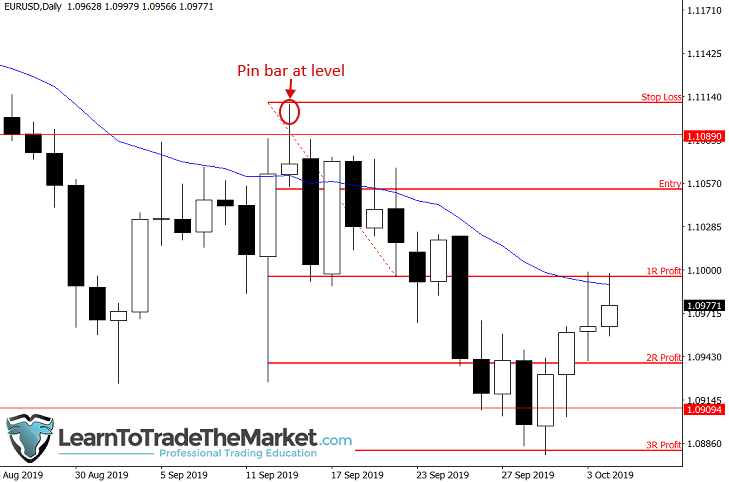

- This instance exhibits a transparent pin bar promote sign that shaped at resistance (each horizontal and ema) and inside a downtrend. This was a really clear and apparent commerce for a savvy worth motion dealer. Cease loss was simply above the pin bar excessive and a 2-3R revenue was simply achieved if you happen to held the commerce for a few weeks.

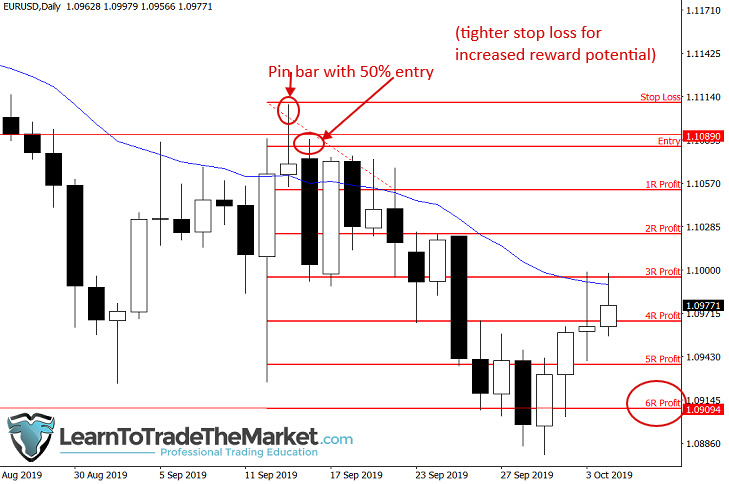

- An fascinating “twist” on the final commerce above is seen beneath. Discover the entry was made as a 50% retrace entry of the pin bar’s tail.

- This entry permits for both a tighter cease loss and therefore elevated potential threat / reward OR with a standard width cease you possibly can give the commerce extra respiration room. On this case, we’re displaying a tighter cease with elevated threat reward, 6R was doable right here!

Conclusion

In right now’s lesson, I’ve proven you ways I personally analyze the charts every week and day and gave you a ‘peek’ into my very own private buying and selling habits. Hopefully, after studying right now’s lesson (and re-reading it) you now have a greater understanding of WHY you want a day by day buying and selling routine and HOW to develop one.

The above day by day buying and selling routine is the core basis that every one of my trades are constructed on, and it’s my opinion that every one aspiring merchants want such a basis to construct their buying and selling profession on in the event that they wish to have a critical probability at making constant cash within the markets.

A lot of I publish a day by day market commentary every day shortly after the day by day Foreign exchange market shut. Nevertheless, what it’s possible you’ll not know is that doing these day by day commentaries (just like above charts) can be a part of my day by day chart evaluation and buying and selling routine. I really began writing down my ideas concerning the markets every day effectively earlier than I began this web site, and it’s one thing I’ve carried out constantly each buying and selling day for concerning the final decade. It’s actually a routine a part of my day by day life…if I miss a day of commentary for some odd cause, like journey or a vacation, I actually really feel ‘unusual’, and like one thing is ‘lacking’. You must get to that time too.

For on-going assist and help with studying to commerce, analyzing the markets, recognizing trades and constructing your personal private buying and selling plan, my day by day commentary and members’ evaluation is a superb instance of how I carry out my rolling (ongoing) evaluation of the market in real-time situations. That is one thing which you can be taught from me and mimic in your charts. I encourage you to “watch over my shoulder” every day as I analyze the charts and plan my trades within the members day by day chart evaluation space and my commerce concepts e-newsletter.

Please Depart A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.