Have you ever ever not taken a commerce after which seemed again in hindsight and wished to kick your self? Ever entered a terrific commerce and exited too early on account of low confidence or over-thinking it, solely to see the commerce go on to be an enormous winner? How typically do you end up in these conditions or comparable?

Have you ever ever not taken a commerce after which seemed again in hindsight and wished to kick your self? Ever entered a terrific commerce and exited too early on account of low confidence or over-thinking it, solely to see the commerce go on to be an enormous winner? How typically do you end up in these conditions or comparable?

In truth, these conditions are unavoidable generally, however in the event you’re discovering that you’re in a continuing state of frustration and remorse along with your buying and selling selections you have to do one thing about it.

What if there was a strategy to scale back these buying and selling errors and the psychological ache that comes from them? What in the event you may begin getting onboard these huge trades that you simply talked your self out of getting into? What if I may assist you remedy this psychological situation and at last set you free?

I’ve excellent news and maybe unhealthy information (relying on the way you have a look at it). The excellent news is: This text goes that will help you perceive what’s inflicting these issues and hopefully provide you with confidence to rectify the difficulty and begin nailing a few of these trades you retain letting get away. No extra dwelling in hindsight saying “I used to be going to take that commerce, however…” or “I used to be going to let that commerce run, however…”. The “unhealthy information” is that I can’t do the give you the results you want, I can present you the proverbial “door” to success, but it surely’s as much as you to stroll by means of it.

So, in the event you’re bored with standing in the identical spot, getting nowhere quick, right here is the trail, all you must do is begin strolling down it…..

1. Be taught what recency bias actually means and how one can cease it

People are likely to make selections concerning the future by wanting on the previous and for good motive; that is often a really useful conduct that may stop us from repeating the identical errors again and again. Nevertheless, though this evolutionary intuition has helped us transfer ahead over the centuries, in buying and selling, it tends to work towards us. We name ourselves “optimists” once we study from the previous, and certainly that’s usually a really optimistic factor to do, however in buying and selling, in an surroundings with so many random outcomes, it may make us “pessimists” in a short time.

Permit me to elucidate with an instance….

We are likely to suppose that what occurred lately up to now will impression what’s about to occur subsequent, and in MOST conditions that may be true. Nevertheless, in buying and selling, there’s a random distribution of winners and losers for any given buying and selling edge. So, this implies you by no means know for positive which commerce will win and which lose, even when your edge is say 80% worthwhile over time. Even in a really small pattern measurement of three successful indicators and a pair of shedding indicators on a random part of a chart, a dealer may take 1 of the shedding trades in that collection and get mentally “shaken out”, which means they freeze like a deer in headlights and skip the subsequent completely good sign purely as a result of recency bias in buying and selling. In different phrases, they’re being overly-influenced by the previous / latest commerce’s outcomes when in actuality, these outcomes have little to nothing to do with the subsequent commerce’s end result.

An instance of recency bias in motion:

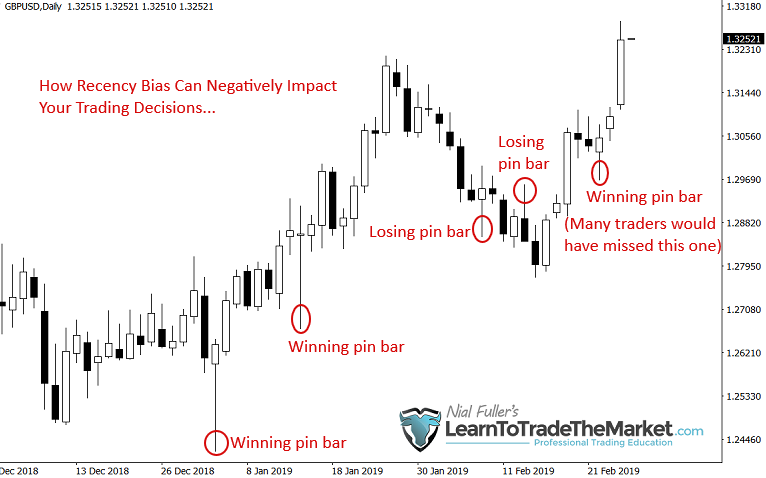

Now, let’s have a look at a latest real-world instance of how recency bias can negatively impression your buying and selling:

In case your major buying and selling edge was pin bars on the each day chart time-frame, you’d have been taking the primary two indicators labeled “successful pin bars” on the chart under. These had been lengthy tailed pin bars, considered one of my favourite sorts. You might have profited from each of these or at worst, gotten out at breakeven, OK, no hurt no foul.

Now, issues get a bit extra fascinating…

We are able to then see there have been back-to-back pin bars that ended up shedding. So, had you taken these two pin bars, in the event you let recency bias “get you”, there was a VERY slim probability you had been taking the final pin bar to the appropriate on the chart; which has ended up working fairly properly as of this writing. That is proof of why you have to proceed taking trades that meet your buying and selling plan standards, regardless of latest commerce failures or outcomes that you simply didn’t like. You (nor I) can see into the longer term, so to try to “predict” the result of your subsequent commerce primarily based solely on the final, will not be solely futile, however silly.

- I shall be trustworthy with you, we mentioned the 2 “shedding” pin bars you see within the chart above in our each day members e-newsletter, once they fashioned. They failed, as trades generally do. However, we then additionally prompt merchants take into account shopping for the newest pin bar purchase sign on the far proper of the chart, which you’ll see is understanding fairly properly, DESPITE the earlier two pin bars not understanding. This, my associates, known as TRADING WITH DISCIPLINE. In case you let that recency bias get you, you’d have sat out, fearing one other loss, you then’d be riddled with remorse seeing the final pin bar understanding with out you on board. Remorse, may be very, very harmful, this may result in you leaping again into the market and making a ‘revenge’ commerce (over-trading) and this in fact leads to extra shedding.

- Once more, the idea I’m attempting to press house is believing in your edge and sticking to it. It’s essential to perceive that the result of every commerce is considerably random and winners and losers are randomly distributed over the chart, as talked about above. That doesn’t imply we shall be taking each commerce as a result of we are going to filter our indicators utilizing the TLS confluence filtering mannequin that I train my college students, however as we will see with this real-world and up to date instance on GBPUSD, once you see these indicators, they fairly often result in big strikes and we now have to attempt to be on board a big proportion of them for our winners to out-gain our losers.

2. Don’t let worry of loss mentally disable you

The worry of loss, of shedding once more, is a really highly effective catalyst for lacking out on completely good trades. I’m not denying that it’s tough to take a commerce after a shedding streak, however you have to get to a degree the place it isn’t. As we talked about above, it’s foolish to maintain pondering you’ll proceed shedding simply because the final commerce was a loser.

- To keep away from this worry, or to extinguish it, you have to really deal with every commerce because it’s personal occasion and as an distinctive expertise, as a result of that’s precisely what it’s. You undoubtedly must NOT over-commit to anyone commerce, which means, don’t threat an excessive amount of cash! You have to shield your bankroll (buying and selling capital) with the intention to all the time really feel assured and optimistic, in order that you realize you’ll be able to lose a commerce or a number of in a row and preserve going and be simply fantastic. Keep in mind, your buying and selling capital is your “oxygen” out there, so be sure you all the time have a lot with the intention to preserve “respiration” correctly.

Many merchants typically affiliate destructive experiences or occasions of their private lives with their buying and selling. These “unhealthy issues” in our private lives can manifest in our buying and selling or funds (take into consideration the addicted gambler shedding all his cash on the on line casino).

- This will develop into fairly complicated, psychologically talking, however simply know that you simply want to have the ability to “compartmentalize” your private life and destructive issues occurring with it, out of your buying and selling. If which means you don’t commerce for per week or two till a destructive expertise will not be affecting you anymore, then that’s what it means. However, you have to shield your buying and selling mindset and bankroll in any respect prices.

3. Don’t let overconfidence result in a insecurity

All of us begin out optimistic and assured however the market usually shatters that shortly. We are able to set ourselves up for years of ache if we exit and check out buying and selling with out the appropriate research and apply.

We begin out excited and motivated, learn a couple of books, watch a couple of movies, do a course, and we exit and threat a large chunk of our hard-earned cash. This will destroy even a terrific dealer within the making, among the greatest merchants don’t make it as a result of they merely didn’t wait their flip and respect the market and the method. One big blow to funds can value them the subsequent decade mentally and financially. One collection of shedding trades can mentally disable even probably the most gifted and smartest merchants.

- You have to use your head at first of your profession and really at some stage in your profession. Certain be assured, however first shield capital, research these charts each day and stick with that routine each day, grind it out week in week out and commit. Follow your craft, grasp your craft. Be at one with the charts.

4. Develop your instinct and intestine really feel

Damaged merchants lack intestine really feel and instinct, they’ve stopped trusting themselves. We have to get you again up on the horse and get that sixth sense (intestine buying and selling really feel) activated once more. Jesse Livermore, in his ebook Reminiscences of a inventory operator, typically talked about “feeling the market” and “realizing what was about to occur by a hunch or feeling”, to cite him:

A person should imagine in himself and his judgment if he expects to make a dwelling at this sport. That’s why I don’t imagine in ideas. – Jesse Livermore

- In case you establish and repair the three points we mentioned above, then your intestine really feel and instinct will develop slowly however absolutely, like an athlete’s stamina. As soon as this occurs, once you go to take a commerce you’ll start to robotically “paint” a psychological map into the longer term from the bars on the chart to the appropriate and your intestine really feel instinct will serve you properly in constructing the boldness to enter the commerce. For a value motion dealer such as you and I, this begins with studying to learn the footprint of the market left behind by the value motion / value motion.

- One other factor you are able to do to assist develop your intestine buying and selling really feel or instinct is put collectively a listing of each day buying and selling mantras that you simply learn to your self, like the next:

I’m assured in my buying and selling edge and my capacity to commerce it.

I’ll respect my filtering guidelines and pull the set off on legitimate trades.

I can’t cover behind my filtering guidelines to excuse me from pulling the set off.

I belief my instinct and intestine really feel.

I can’t overthink this subsequent commerce.

I don’t care concerning the end result of my final commerce, it’s irrelevant to my subsequent commerce.

5. Perceive that the stats don’t lie

Many instances, merchants miss successful trades as a result of they merely suppose themselves proper out of them on account of not trusting or understanding the precise details and statistics of buying and selling. Let me clarify…

As I touched upon earlier on this lesson, there IS a random distribution of wins and losses for any given buying and selling edge. What this implies is that, regardless of your buying and selling edge having XYZ win share, you continue to don’t ever know “for positive” WHICH commerce shall be a winner and which shall be a loser, the implications of this buying and selling truth are three-fold:

- There is no such thing as a level in altering your threat significantly between trades, since you have no idea if the subsequent setup will win or lose, regardless of “how good” it appears.

- You can not keep away from shedding trades, all you are able to do is study to lose correctly. When merchants attempt to keep away from losses by doing issues like pondering they’ll “filter” out losers or every other equally hair-brained thought, they put themselves able to blow out their buying and selling account as a result of they’re now attempting to foretell that which is unpredictable which results in an entire host of different buying and selling errors.

- Anybody commerce is just insignificant within the grand scheme of your buying and selling profession, or not less than IT SHOULD BE. In case you are making anyone commerce overly-significant by risking an excessive amount of cash on it and develop into overly-mentally connected to it, you’re setting your self up for sure “dying” within the buying and selling world.

Conclusion

Buying and selling will not be about by no means lacking a commerce or by no means having a shedding commerce, under no circumstances. Nevertheless, in the event you discover that you’re chronically lacking trades and in a state of remorse about your buying and selling, you then do must make some adjustments.

As merchants, our primary “enemy” and “competitor” out there is ourselves. How lengthy it takes you to comprehend that, settle for it and do one thing about, will decide how lengthy it takes you to start out getting cash out there. Right now’s lesson has recognized and supplied a number of options to 1 facet of buying and selling that usually causes folks to “shoot themselves within the foot”, so to talk; lacking out on successful trades.

Your mission as a dealer is to completely overcome and eradicate the entire numerous self-defeating behaviors that each dealer should conquer to succeed in a stage the place you’re giving your self the very best probability at getting cash out there. That is what I always attempt to train college students through my skilled buying and selling programs and it’s my hope that by following me and studying from me you’ll ultimately get out of your individual method and have the ability to benefit from the highly effective value strikes the market affords up once in a while.

Please Depart A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.