The Russell 2000 ETF (IWM) closed beneath the 200-day SMA for the primary time since, properly, June 1st. The final cross was not that way back and up to date crosses merely resulted in whipsaws. Fact be informed, 200-day SMA crosses are usually not that related for IWM.

Testing 200-day SMA Crosses for IWM (and SPY)

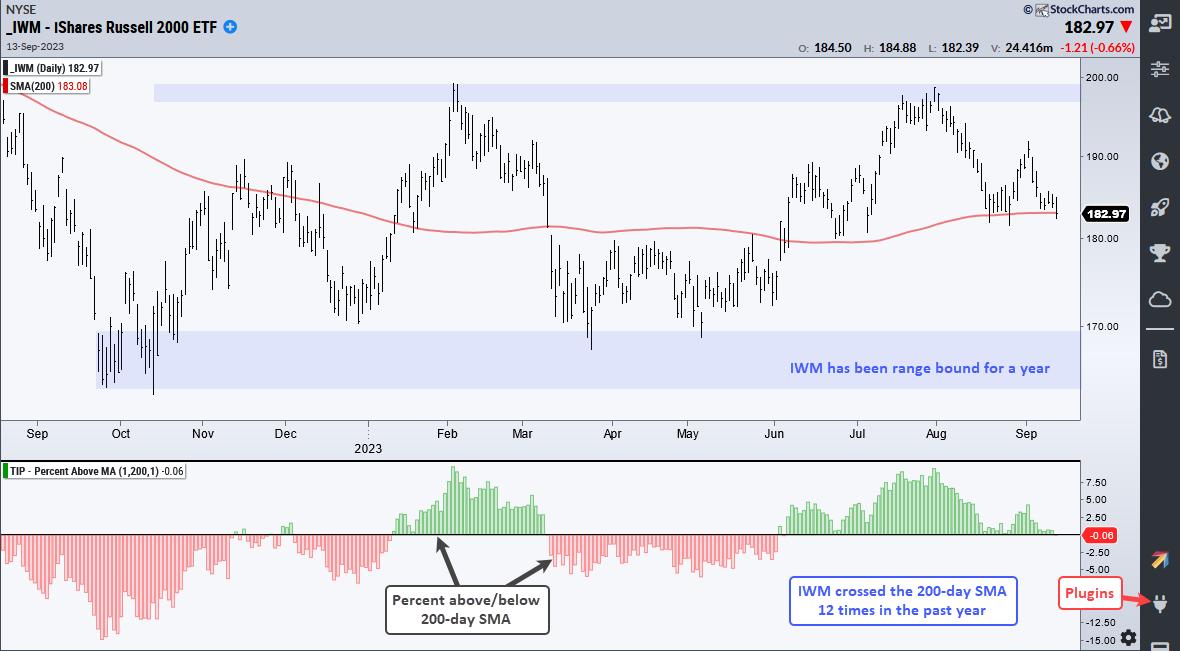

The chart beneath exhibits IWM within the high window and the P.c above MA (1,200,1) indicator within the decrease window. This indicator turns inexperienced when IWM closes above its 200-day and purple when IWM closes beneath. There have been fourteen crosses up to now 12 months alone. Word that this indicator is a part of the TIP Indicator Edge Plugin for StockCharts ACP.

IWM 200-day SMA

IWM 200-day SMA

A dozen crosses and nothing to indicate is sensible as a result of IWM is caught in a buying and selling vary. Shifting averages are trend-following indicators that carry out poorly when worth strikes sideways. The chart above exhibits IWM buying and selling between 162 and 200 since final September (blue shading). Shifting common alerts are leading to whipsaws.

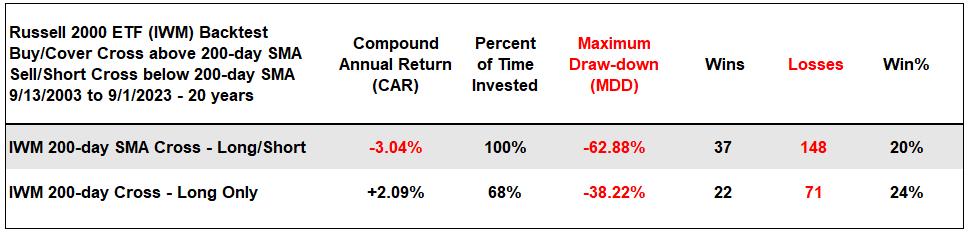

One 12 months will not be lengthy sufficient to determine the efficacy of a shifting common cross. As such, I examined the 200-day cross in IWM over the past 20 years. The primary take a look at is a protracted and quick take a look at. This implies shopping for/protecting on a cross above the 200-day SMA and promoting/shorting on a cross beneath the 200-day SMA. As the highest line exhibits, such a method didn’t work as a result of the Compound Annual Return was -3.02%.

The second line exhibits a protracted solely technique and the 200-day cross managed to make some cash. Not a lot although. The Compound Annual Return was a meager 2.09%. This meager return got here with a excessive value as a result of the Most Drawdown was a whopping 38.2%. For comparability, SPY generated at 5.68% Compound Annual Return with a 21.98% Most Drawdown. There may be some worth in SPY alerts. As such, I might ignore the 200-day SMA crosses in IWM and take note of alerts in SPY.

Try the Chart Dealer report at TrendInvestorPro to study extra on present market circumstances. Thursday’s report lined:

- risk-on/risk-off dynamics out there

- lack of participation in two breadth indicators

- a key take a look at for the 20+ Yr Treasury Bond ETF

- a key tech ETF breaks and one other teeters

- three defensive shares with bullish breakouts

Click on right here to study extra and achieve instant entry.

—————————————

Arthur Hill, CMT, is the Chief Technical Strategist at TrendInvestorPro.com. Focusing predominantly on US equities and ETFs, his systematic method of figuring out pattern, discovering alerts throughout the pattern, and setting key worth ranges has made him an esteemed market technician. Arthur has written articles for quite a few monetary publications together with Barrons and Shares & Commodities Journal. Along with his Chartered Market Technician (CMT) designation, he holds an MBA from the Cass Enterprise College at Metropolis College in London.