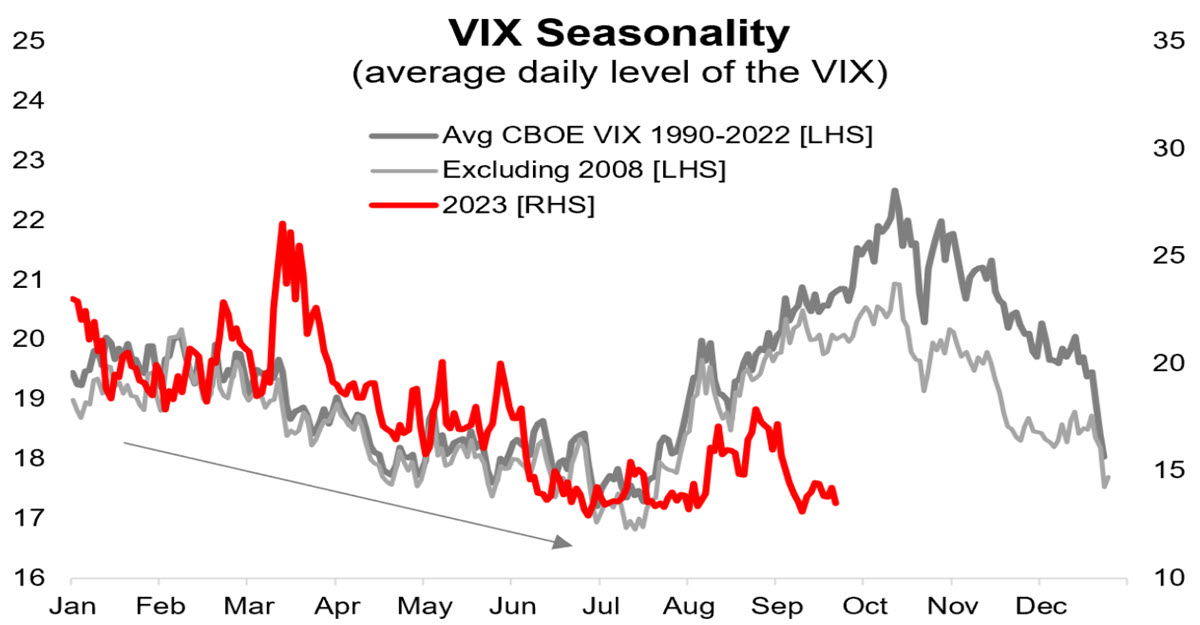

You might have already seen this chart: it represents the seasonality of the worry index, the VIX, from 1990 till final yr (in darkish gray). There’s additionally a line (mild gray) that does the identical factor, however excludes 2008, which was a very risky yr as a result of GFC and due to this fact an outlier.

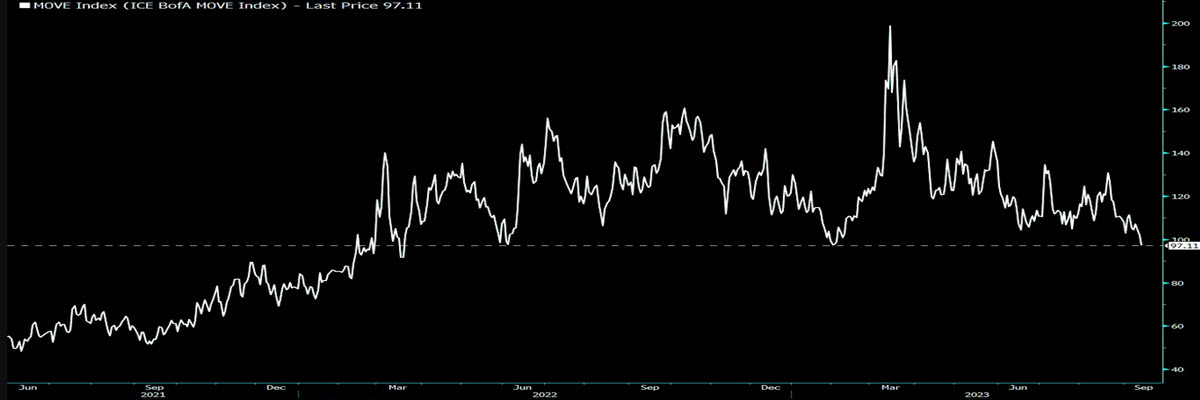

This chart has been round for not less than a few months, since July, when statistically the VIX begins to rise as a prelude to a not significantly beneficial time of yr (we analysed September’s seasonality just a few days in the past). Nevertheless, this yr goes in a totally totally different path, for now: yesterday the volatility index closed at 13.88, the second lowest stage after the 13.22 recorded in mid-July and as soon as once more beneath the pre covid ranges (which at one level appeared to have been overcome, as if there have been a brand new regime of higher worth dispersion). The attention-grabbing factor is that this isn’t even the one case- usually the volatility of all property is near the lows of the final two years: just a few days in the past MOVE, the bond volatility index, reached the bottom stage since March 2022; the subsequent chart is a Cross Asset Volatility index comprising Fairness, Fastened Earnings, Currencies, Oil and Excessive Yield Credit score, which can also be near 18-month lows. Briefly, we’re in a state of affairs which – regardless of inflation and financial coverage – appears to profit Purchase and Maintain traders and people utilizing Carry Commerce methods given the essential stability of the setting.

(a) BOFAML, MOVE Index, (b) Cross Asset Volatility

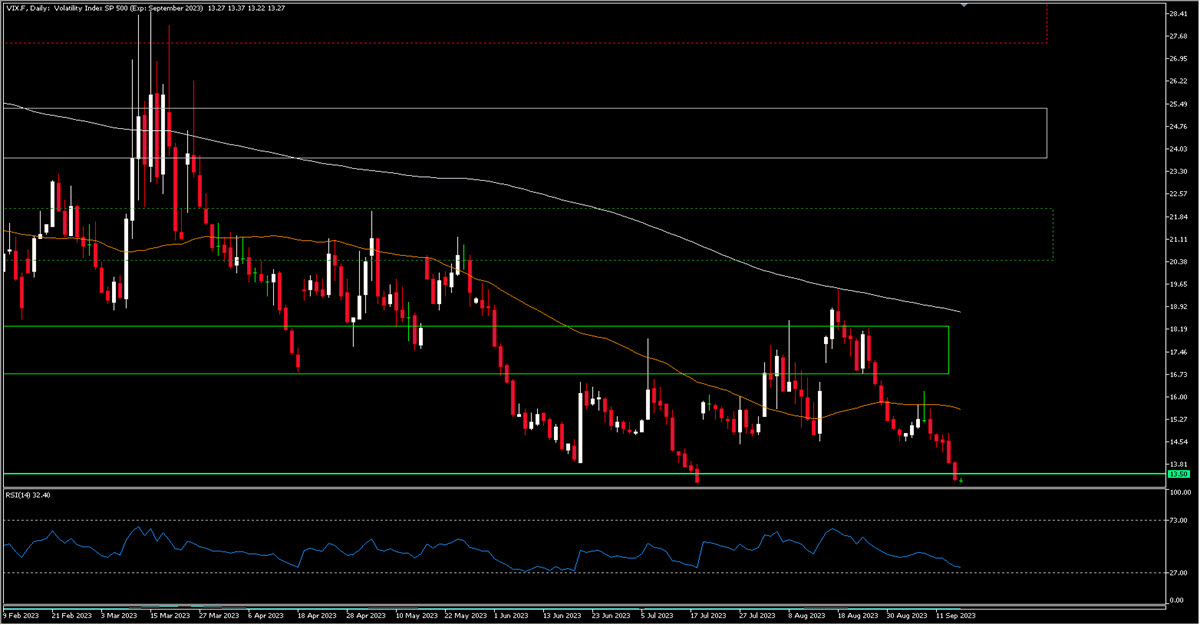

Definitely, making use of technical evaluation to the VIX chart one can see that the worth of implied volatility is low and really near a earlier backside. However plainly volatility promoting methods have gotten increasingly more fashionable on this market which can also be flooded with 0dte choices. This implies promoting choices (volatility) to earn a premium, a form of yield. They’re extensively utilized by digital market makers, who’re among the many essential gamers in offering liquidity to indices (and hedge with choices). After all, the shock might come from a sudden unfolding of those extremely concentrated methods, however this normally occurs after particular ranges have been damaged.

Definitely, making use of technical evaluation to the VIX chart one can see that the worth of implied volatility is low and really near a earlier backside. However plainly volatility promoting methods have gotten increasingly more fashionable on this market which can also be flooded with 0dte choices. This implies promoting choices (volatility) to earn a premium, a form of yield. They’re extensively utilized by digital market makers, who’re among the many essential gamers in offering liquidity to indices (and hedge with choices). After all, the shock might come from a sudden unfolding of those extremely concentrated methods, however this normally occurs after particular ranges have been damaged.

13.22 was the low in the beginning of July and can be utilized as a buying and selling reference, as a cease stage (be it cease loss – get out of the order – or cease order – enter it). One factor to recollect is the asymmetrical habits of the VIX: it falls slowly and rises explosively. Downwards it’s nearly in unchartered territory, given the degrees of latest years, upwards 14.75, 15.60, 16.10 and 16.60 are the degrees to observe.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is supplied as a basic advertising communication for info functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication comprises, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All info supplied is gathered from respected sources and any info containing a sign of previous efficiency will not be a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the data supplied on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.