Do you might have a favourite sauce? Considered one of mine is a candy chili sauce that I take advantage of on salmon, cucumber salad, and different recipes. Most everybody has a favourite sauce or a dip, with a couple of hundred varieties to select from. You could like a selected marinara, tzatziki, or tahini. You could fancy a chutney, wasabi, soy, or sriracha. Whether or not you want béchamel, béarnaise, or barbecue, there’s undoubtedly some type of sauce that you just periodically simply crave.

The unusual factor about sauces, although, is that they’re meals, however they aren’t a meal. They aren’t soup. They aren’t interesting on their very own. They’re merely meant to be “meals assist.” They complement and improve. Sauces aren’t the factor. They get added to the factor to make it higher. Every part tastes a bit of higher with the proper of sauce.

It’s the identical with information. Information isn’t the factor. It’s essential and might make or break your insurance coverage operation. However information is a key supporting participant, an integral a part of the merchandise, companies, and experiences it enhances.

Information is the lifeblood of insurance coverage and the important thing to unlocking the ability and potential in a lot of what insurers do. Information is the important thing to underwriting established merchandise correctly. It’s the important thing to growing new merchandise primarily based on new markets and newly out there information sources. It’s the important thing to profitable the revenue recreation. It’s the important thing to establish fraud. There may be nearly nowhere in insurance coverage that received’t enhance if you know the way to use information in the fitting method. In insurance coverage, every thing goes higher with information.

The issue is that many insurers are having hassle getting the sauce out of the kitchen. They’ve a number of the proper elements. They’ve some inspiration. They’ve a couple of recipes of their field. However, they’re stymied on tips on how to make one thing magnificent out of the bits and items that appear like they could go effectively collectively.

It was once, with information, the time it took to determine it out didn’t matter a lot. Insurers might take their time, create their fashions, and run some numbers. Insurers might spend years and years turning information into growth, however that’s not potential right this moment. Property insurers, particularly, are in a spot the place they MUST get their information and analytics working for them shortly, or it received’t be working in any respect.

The true reply within the information recreation is to determine the place the info could also be utilized, the place it’ll have essentially the most affect, and do the most effective. Majesco, in truth, has already completed this evaluation many occasions over and is utilizing these insights in our options for the business. We’ve got discovered, time and time once more, that the alternatives for insurers are discovered within the gaps between what is anticipated by clients and what’s at the moment in vogue for insurers. When insurers catch as much as clients, they fill the gaps, and on this case, that implies that insurers can be utilizing information and analytics in a method in that can positively affect each their clients and their inner operations. For those who’d like to know these gaps in larger element, you must learn Majesco’s current survey report, Bridging the Buyer Expectation Hole: Property Insurance coverage.

Why rush the info and analytics recipe?

The state of the property insurance coverage enterprise is more and more difficult. It wants a change of operations and expertise that makes use of information intelligently to stay viable and worthwhile. 2022’s pure disasters had a big impact on the business. However 2023 is worse. Based on the newest NOAA report, the US skilled 23 separate billion-dollar climate and local weather disasters within the first 8 months of 2023 – the most important quantity since data started and already surpassing the earlier document of twenty-two occasions in 2020. And this was earlier than the newest hurricanes and with 4 months to go in 2023.

The rising variety of excessive climate occasions and pure disasters has had a considerable impact on individuals and companies. With rising property costs, supplies, and restore prices, many insureds lack enough insurance coverage protection, leading to a niche and elevated monetary threat.

The affect of that is that property disaster reinsurance charges are rising. The January 2023 renewals mirrored 20-year highs, persevering with a trajectory that started in catastrophe-exposed property versus non-catastrophe uncovered property, resulting in large worth variations. Demand for protection has grown as pure disasters proceed to affect clients and insurers alike. However different elements reminiscent of inflation, provide chain challenges, dramatic property worth will increase, and monetary market losses are driving the business additional into a tough market. This development is solidified by the American Property and Casualty Insurance coverage Affiliation noting in a 2023 report, that the mixture of historic excessive inflation and the rising frequency of pure catastrophes has created the toughest market in a era for property insurance coverage.[1] We will possible count on excessive charges once more for 2024 renewals given what has occurred this 12 months.

What’s the answer?

Insurance coverage losses are leading to greater premiums for patrons, greater premiums for reinsurance for insurers, and a refocus on the underwriting self-discipline, new merchandise, and value-added companies that concentrate on threat resiliency with prevention and mitigation.[2]

So, the place can any insurer discover alternative within the mild of an setting that begs for adaptation and innovation?

Effectively, there’s information. Business property buildings, for instance, are more and more turning into “good” and delivering huge quantities of information by way of real-time linked gadgets built-in with Constructing Administration Techniques (BMS) that can be utilized to watch, predict, and forestall loss. Along with defending the constructing setting from dangers reminiscent of water leaks, fireplace, or equipment put on, sensors can assess exterior dangers reminiscent of climate, to supply a 360-degree view of threat in real-time.

And there may be loss management – both with adjusters or utilizing digital capabilities like video and self-surveys to seize photos, information, and different details about properties – each business and private after which assess that information for threat.

Each of those are a chance, and due to the proliferation of sensor and good applied sciences, digital loss management capabilities like Majesco Loss Management, to not point out the brand new applied sciences reminiscent of ChatGPT and actionable AI, there are various extra alternatives similar to it.

The adage of “management what you’ll be able to management” is now entrance and middle for insurers as they take a look at new threat administration methods as a vital element of their buyer technique and their property traces of enterprise. Insurers should more and more focus their time and assets on how they’ll higher assess threat for a broader set of properties and forestall losses to enhance underwriting profitability and buyer experiences. The answer will contain information, superior analytics, and different instruments that harness information’s energy, however the answer will solely be viable for insurers who’re keen to catch up, proper now. Information will stretch insurers and their capabilities, however it’ll stretch them in the fitting path, making ready them for a way more environment friendly and worthwhile future.

Information & Analytics for Property Pricing and Underwriting

P&C underwriting is on the coronary heart of the insurance coverage enterprise. From evaluating particular person dangers and the exposures in a whole portfolio to assessing the chance, threat urge for food, and in the end profitability, underwriting is more and more essential within the face of quickly altering threat elements. On the core of underwriting is information.

Insurance coverage has at all times been a data-driven enterprise, however entry to new information sources for properties and using AI/ML is redefining and revolutionizing the business. Threat administration, underwriting, and loss management all contain gathering and utilizing information wanted for AI/ML fashions to precisely assess and establish threat, and handle and cut back dangers.

Majesco has the business’s most intensive repository of property loss management survey information, encompassing over 2 billion observational information factors from 16+ million meticulously accomplished property surveys carried out by skilled threat engineers within the discipline. These surveys, rigorously quality-assured, embody a staggering 200+ million tagged pictures, offering the perfect basis for harnessing the potential of AI/ML. We’ve got used this information to develop our Property Intelligence AI/ML mannequin to assist assess particular property information utilizing this repository of information. Utilizing this information and our mannequin, insurers can personalize the pricing and underwriting for the client’s particular threat.

Business Property SMB – Insurer Gaps in Information Use and Curiosity

Keep in mind when insurance coverage’s excuse for not utilizing information was that clients didn’t need to hand over their key bits of related information, even when it meant that it will save them cash? Who may need guessed that the difficulty has flipped and that now it might be that insurers might lose enterprise as a result of clients are keen to share the info and insurers aren’t able to make a buyer’s information work for them.

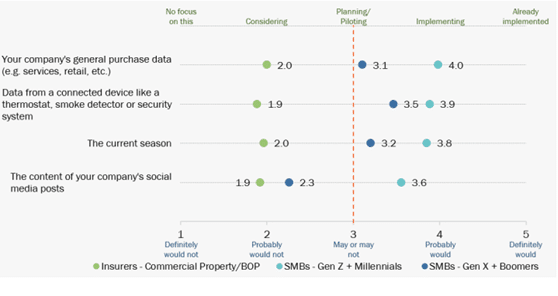

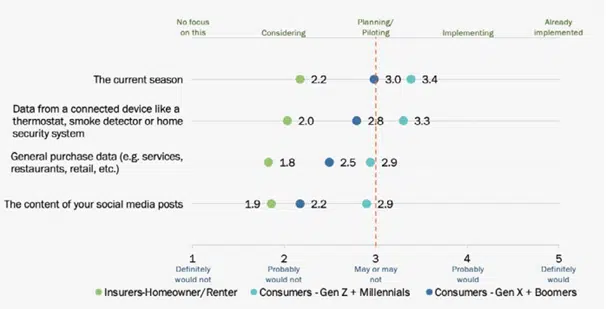

Based on Majesco surveys, the previous excuse evaporated within the business market. Overwhelmingly, SMBs are keen to share information with insurers to cost and underwrite their business property insurance coverage at almost double the speed that insurers are at the moment utilizing this information, as mirrored in Determine 1. Curiously, each generational teams agree, apart from social media content material, the place the older era aligns with insurers.

Determine 1: Buyer-Insurer gaps in new information sources and applied sciences for business property insurance coverage pricing and underwriting

The expansion of IoT gadgets and sensors all through properties and companies is accelerating. Along with sensors (temperature, water, infrared, sound, and many others.), we’re witnessing large development in video surveillance (with cellular capabilities), significantly given the rise in crime because of societal threat.

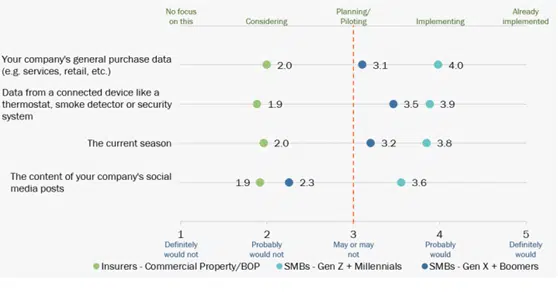

Based on a BCG article, in 2020 there have been 30 billion linked gadgets on the earth, which is anticipated to extend by over 30%, to 41 billion gadgets by 2024.[3] Immediately’s IoT gadgets embedded in gear and infrastructure for business companies produce over 14 zettabytes of information, with numerical or visible data on individuals, issues, and environmental elements, as mirrored in Determine 2. The breadth of this information gives the chance to make use of it in real-time, slightly than depend on historic information for threat evaluation and underwriting, whereas additionally offering new information that offers extra perception into the chance.

Determine 2: Forms of information generated by business IoT gadgets

Actually, companies are making the most of IoT-based applied sciences to streamline processes, improve effectivity and security, and supply safety. It’s estimated that just about 34% of North American and European companies use IoT gadgets, with one other 12% planning to combine IoT throughout the subsequent 12 months.[4]

Insurers’ skill to create buyer worth from the IoT will rely on their willingness to dive in and begin experimenting with IoT expertise and information right this moment. Leaders are doing this and can outpace those that comply with, placing them vulnerable to protecting their clients. Insurers that want to stay viable, should catch up of their use of information within the business market.

Private Property Client – Insurer Gaps in Information Use and Curiosity

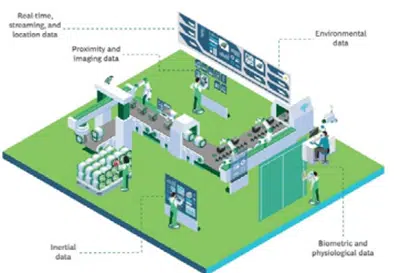

Just like SMBs, shoppers are overwhelmingly all in favour of utilizing their information for pricing and underwriting of their property insurance coverage as mirrored in Determine 3. Actually, they’re as much as 2 occasions extra than insurers, reflecting a big buyer expectation hole.

Determine 3: Buyer-Insurer gaps in new information sources and applied sciences for private property insurance coverage pricing and underwriting

Based on CoreLogic’s Residential Price Handbook, almost 64% of house owners don’t have sufficient insurance coverage protection and are underinsured by a mean of 27%.[5]

This isn’t shocking, given the rise in property values. In November 2021, it was reported that the median worth of single-family current properties rose in 99% of the 183 markets tracked by the Nationwide Affiliation of Realtors within the third quarter, with double-digit worth will increase seen in 78% of the markets.[6]Over the past couple of years, costs have risen from 15% to over 30% on common, with some markets even greater. Think about doing a digital loss management survey through self-survey or video in your complete guide of enterprise to higher assess every property threat, but additionally to higher assess reinsurance wants. Majesco has clients who’re doing simply that with nice success.

Including gasoline to the change, it’s anticipated that good house gadgets will proceed to be a serious space for IoT, with over 800 million good house gadgets shipped in 2020 and predicted to exceed 1.4 billion by 2025. It’s estimated that 41.9% of US households owned a sensible house gadget in 2021, which can rise to just about 50% by 2025. The result’s the variety of good house gadgets bought will exceed 1.94 billion by 2023.[7]

This development in adoption gives insurers a major alternative to fulfill buyer expectations by capturing and utilizing the info for personalised threat assessments and underwriting. With the elevated valuations and the expansion of the adoption of good house gadgets, clients are more and more all in favour of personalised pricing and underwriting primarily based on their very own location and property particulars. Insurers should start to deal with this want and expectation to amass and retain clients. Buyer loyalty is in jeopardy as soon as personalised pricing takes over the market. Solely insurers which can be assembly expectations can count on to hold on to and develop their enterprise and portfolio of shoppers.

However greater than that, solely insurers who actually perceive their enterprise, utilizing information as their information, will know which enterprise they need and which they don’t need. The information-smart insurer will profit from the data-vetted portfolio.

Majesco is, proper now, serving to insurers to transition their operations to catch up within the information recreation. These firms are making ready to reap the benefits of market-leading information and analytic applied sciences for P&C insurance coverage. They’re making higher selections utilizing information and analytics and are proving how every thing within the insurance coverage operation goes higher with information. Majesco’s Clever Core for P&C, Loss Management, and Property Intelligence is at the vanguard of what main insurance coverage operations want now, and within the very close to future.

“The necessity for fast product innovation, environment friendly operations, and strong digital capabilities is driving the necessity for core methods wealthy with APIs and accessible information. Majesco gives a P&C Coverage answer with an open structure and self-service configuration instruments that allow insurance coverage carriers to deploy the capabilities wanted to achieve this new period of insurance coverage. Majesco’s sizable buyer base and continued momentum out there qualifies them as a Dominant Supplier within the P&C core methods area.” — Martina Conlon, Head of Property and Casualty Insurance coverage at Datos Insights.

Do you perceive what it means to have an Clever Core and superior information and analytics working your enterprise? Take a look at Majesco’s newest webinar, The Daybreak of Clever Core Insurance coverage Software program, for a peek at how information and AI/ML, working collectively, will rewrite the principles of P&C insurance coverage.

[1] Sams, Jim, “APCIA Says Property Insurance coverage Market ‘Hardest in a Technology’,” Claims Journal, March 28, 2023, https://www.claimsjournal.com/information/nationwide/2023/03/28/316110.htm

[2] “Info + Statistics: Owners and renters insurance coverage,” Insurance coverage Data Institute, https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

[3] Taglioni, Giambattista, et al., “The Energy of the Web of Issues in Business Insurance coverage,” BCG, October 4, 2021, https://www.bcg.com/publications/2021/commercial-insurance-should-start-testing-the-power-of-the-internet-of-things

[4] Vailshery, Lionel Sujay, Web of Issues (IoT) within the U.S. – statistics & information, Statista, October 27, 2022, https://www.statista.com/matters/5236/internet-of-things-iot-in-the-us/

[5] “Report: How Many US Houses Are Underinsured?” Kin, April 12, 2021, https://www.kin.com/weblog/underinsurance-report/

[6] “Dwelling Costs Spiked In Practically All Metro Areas In 3Q 2021,” Nationwide Mortgage Skilled, November 12, 2021, https://nationalmortgageprofessional.com/information/home-prices-spiked-nearly-all-metro-areas-3q-2021

[7] Prepare dinner, Sam, “60+ IoT statistics and information.” Comparitech, December 13, 2022, https://www.comparitech.com/internet-providers/iot-statistics/