Strain is making a local weather for change within the restaurant trade. Popping out of a tough few years, pundits would have anticipated eating places to be in important hassle. All the similar components which might be affecting insurers are equally impacting eating places. Expertise is in excessive demand and never simple to search out. Elevated inflation is inflicting a re-ordering of buyer priorities. On the similar time, inflation is impacting provide prices for eating places — each in meals and meals packaging. Ordering expertise is shifting. Prospects are even shifting the time of day they prefer to dine out.

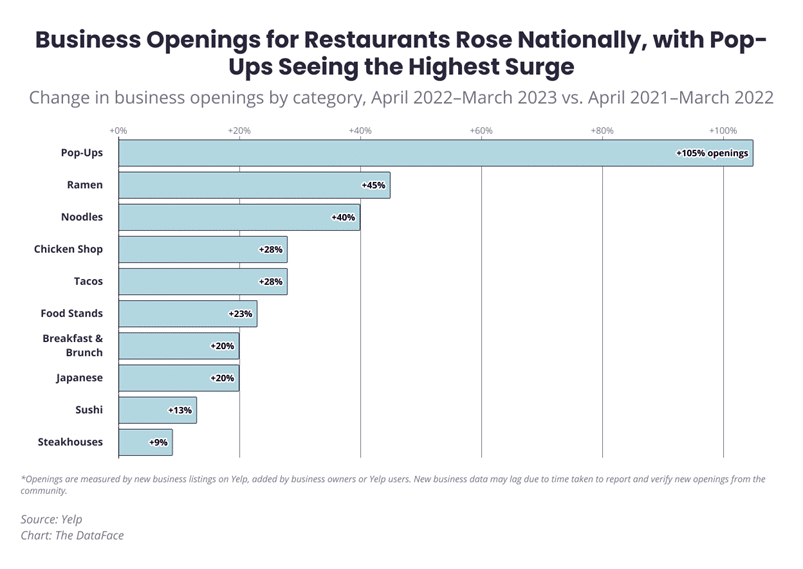

However the stress isn’t inflicting eating places to go away; it’s simply inflicting them to vary. In truth, based on Yelp’s 2023 State of the Restaurant Trade report, enterprise openings for eating places rose nationally in April 2022-March 2023, over the earlier yr.[i] Purchasing and wonder care are industries in decline, however client spending on eating is continuous to rise.

The true proof of buyer and enterprise change within the trade, nonetheless, comes from viewing the sorts of eating places which might be opening and rising. (See Fig. 1). Pop-ups are by far the best progress sector, an indication that individuals are frequently searching for new and authentic choices in eating. Their wants are met by agile, entrepreneurial cooks and traders who’ve their fingers on the heartbeat of tradition and delicacies.

Pressured by prices, expertise, inflation, and altering buyer preferences, the trade’s new leaders are those that moved shortly to create new ideas. Eating places was identified for his or her consistency, however the brand new restaurant tradition is one the place the one consistency is regular innovation.

Determine 1: Modifications in restaurant enterprise openings

The place are right now’s trade pressures pushing the insurance coverage trade?

To search out out the place the insurance coverage trade is targeted, Majesco surveyed customers, SMBs, and insurers. Insurer surveys can provide us insights into how “in contact” they’re with their prospects, market and expertise developments, and the way shortly they’re reprioritizing and executing these adjustments. Rising dangers have the potential to intersect and considerably disrupt companies and folks. Elevated excessive climate occasions, pure disasters, cyber, crime, and extra have an more and more important influence. For insurers, meaning increased claims and decrease profitability, however it additionally means better want and alternative. Are insurers making a path for themselves that can drive higher threat evaluation, profitability, and scale back claims whereas rising market share by means of product and repair innovation? Majesco documented a few of these findings in our thought-leadership report, Recreation Altering Strategic Priorities Redefining Market Leaders.

Are insurers wanting negatively on the issues of change or are they optimistically seeing the alternatives that change creates?

For instance, an insurance coverage hole is at present rising partially due to one high-level issue — property worth escalation. The fast rise in property costs signifies that most individuals and business companies lack sufficient protection and so they don’t even notice it. In November 2021, it was reported that the median worth of single-family current houses rose in 99% of the 183 markets tracked by the Nationwide Affiliation of Realtors within the third quarter, with double-digit worth will increase seen in 78% of the markets.[ii] During the last couple of years, property costs have risen from 15% to over 30% on common, with some markets even increased. Because of the aggressive housing market, many properties didn’t get inspected, leaving unidentified dangers for each the insured and insurer. The result’s the chance that many property homeowners are underinsured given the rising prices to restore or rebuild, posing a possible problem for insurers.

The influence of this lack of protection is a big concern for insurers – from a buyer satisfaction, reinsurance, and profitability perspective. Insurers want to take a look at their broader property portfolio and discover new, modern methods like digital loss management and new knowledge sources to evaluate threat, predict the influence, and provoke loss prevention methods extra precisely and exactly – all areas Majesco is targeted on with our options – Loss Management and Property Intelligence. Likewise, these are issues that insurers must be doing whatever the stress of change. There are two sides to the insurance coverage alternative — operational optimization and market innovation. Each will make the most of improved and new applied sciences.

Personalised Pricing with Information

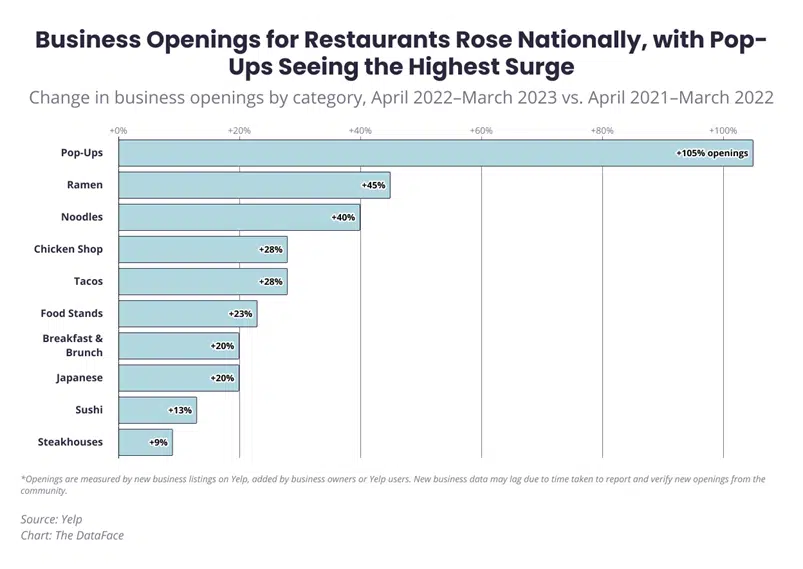

Primarily based on insurers’ survey responses, there’s at present little or no innovation in the usage of new knowledge sources for both private or business property insurance coverage, as proven in Determine 2. This highlights a serious disconnect between Gen Z and Millennial customers and SMBs who’ve a excessive curiosity in these choices. Likewise, Gen X and Boomers had excessive curiosity within the IoT-based possibility of utilizing knowledge from linked units of their buildings/amenities and customers have been very occupied with seasonally adjusted pricing and utilizing knowledge from linked units within the dwelling.

This highlights a serious alternative for insurers. Given the rising hole in protection because of the fast rise in property costs, insurers can shut the hole through the use of loss management assessments and new knowledge sources to determine alternatives for growing protection and addressing a possible lack of applicable reinsurance protection for the books of enterprise.

Determine 2: Use of latest knowledge sources for business and private property insurance coverage

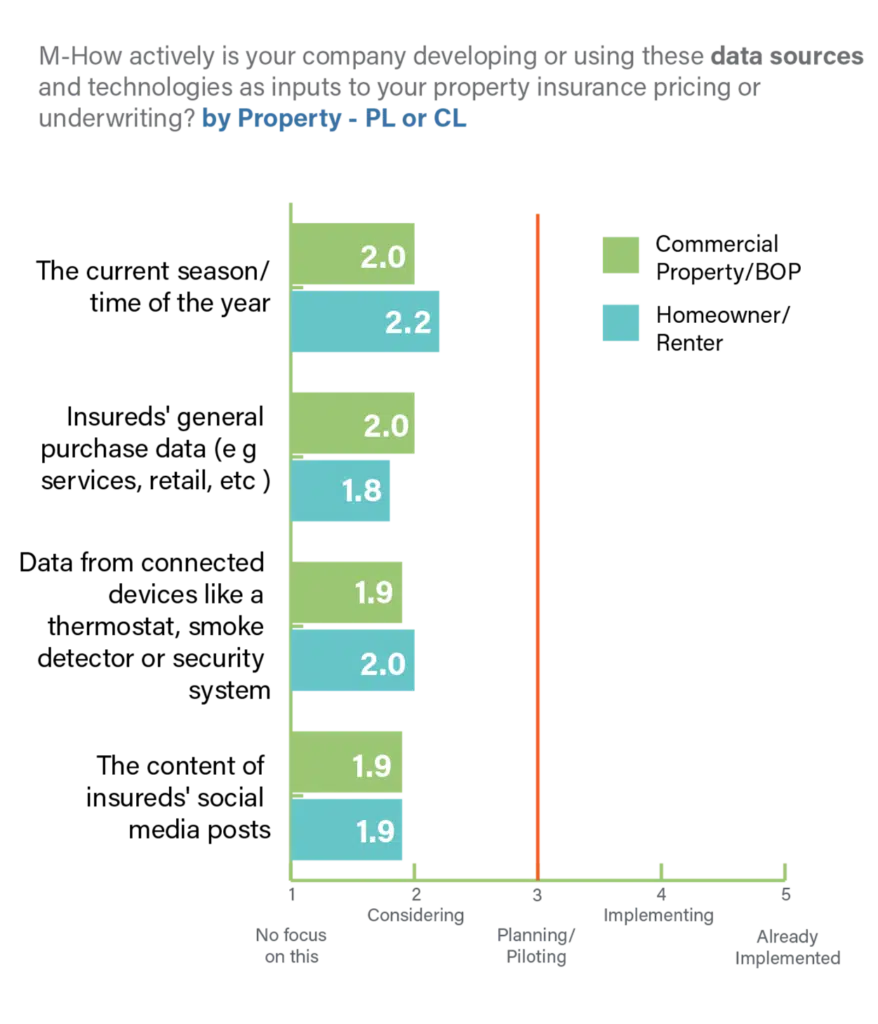

Taking a look at innovation trending for Leaders, Followers and Laggards

This sample of restricted innovation in utilizing new knowledge sources for property pricing continues even amongst Leaders, as seen in Determine 3. Whereas Leaders and Followers are extra actively contemplating seasonal-based pricing, it’s nonetheless to not the Planning/Piloting stage, and the opposite three choices are solely on the Contemplating stage.

Additional property valuations and insurance coverage price hikes are anticipated in 2023 as a consequence of a confluence of things – exasperating an already undervalued property portfolio. With catastrophe-exposed, loss-hit accounts bearing the brunt of tightening capability, tough reinsurance renewals, and elevated ratesof 25% or increased,[iii] there’s an pressing want for innovation in property insurance coverage no matter in case you are a Chief, Follower or Laggard.

Insurers who transfer to execute these choices have a possibility to separate themselves from the competitors on this hardened market. They will solidly set up themselves as front-runners within the sector, no totally different than Progressive did 10 years in the past in auto insurance coverage.

Determine 3: Use of latest knowledge sources for property insurance coverage by Leaders, Followers, and Laggards

Innovation in value-added providers

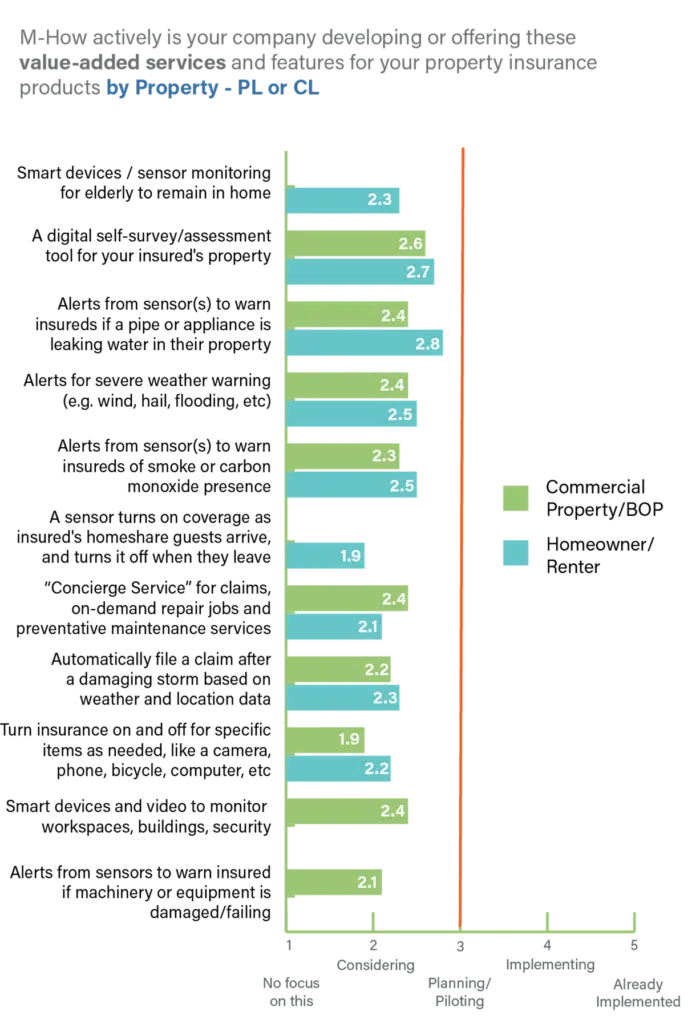

In comparison with new knowledge sources, private and business property insurers present barely extra modern pondering in value-added providers. A number of choices are very near the Planning/Piloting part, notably sensor and data-based alerts as proven in Determine 4.

Alerts and monitoring units/providers like smoke/CO2, water leak, gear failure sensors, or alerts for extreme climate and office/dwelling threats promote security and supply the flexibility for insurers to eradicate or scale back the chance and subsequent claims prices. If insurers did extra loss management surveys – digitally this would supply a threat evaluation for his or her prospects to assist information them in what they’ll do to cut back threat. That is one thing Pennsylvania Lumbermen’s Mutual Insurance coverage Firm has finished as mentioned in a podcast with Erin Selfe. Prospects recognize any service that can provide them peace of thoughts or essential details about their property dangers.

All these choices are extremely desired by customers and SMBs, offering insurers a possibility to proactively meet buyer wants and expectations and create loyalty whereas serving to to handle and keep away from threat that may assist general profitability extra successfully.

Determine 4: Growth of value-added providers for business and private property insurance coverage

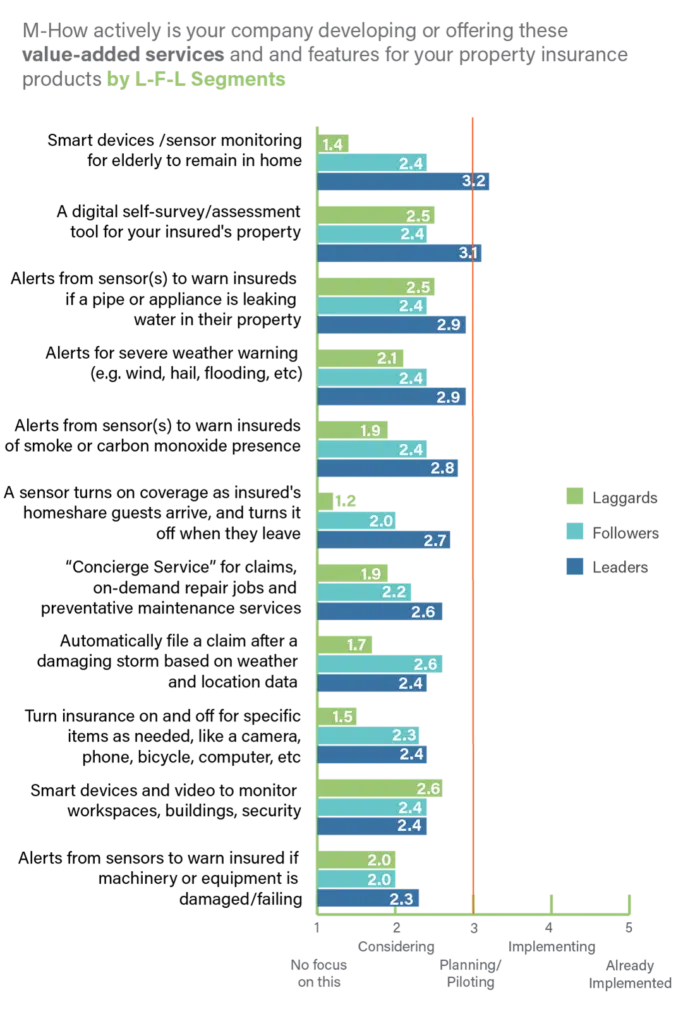

Leaders, Followers and Laggards method to value-added providers

As soon as once more, Leaders stand out of their pursuit of value-added providers to enhance their core threat product, with seven of the eleven (64%) choices above or inside just some factors of the Planning/Piloting part as seen in Determine 5. In distinction, Followers and Laggards are considerably behind which, like auto insurance coverage, hurts their means to create worth and differentiate their choices past a low-price focus.

Immediately’s elevated catastrophes, market surroundings, and stress on profitability demand a better give attention to preventable losses and higher outcomes by means of underwriting profitability, proactive threat mitigation to reduce or eradicate claims, and expanded value-added providers that assist with threat administration and improve the shopper expertise.

Determine 5: Growth of value-added providers for property insurance coverage by Leaders, Followers, and Laggards

Charting new programs

So, the query stays…is right now’s stage of innovation and funding sufficient for insurers to draw and retain right now’s prospects? The place are right now’s Pop-up alternatives within the realm of services? Which corporations are doing one thing actually authentic and modern, utilizing the total capability of knowledge and analytics?

The information suggests that almost all insurers want to meet buyer expectations and appetites for brand spanking new services, and they’re contemplating utilizing knowledge and expertise to a better diploma to optimize threat evaluation and stop claims — however their strategic priorities aren’t essentially aligned to make it occur. The place is your organization on these points?

Most want a plan and a associate to provide them the momentum to compete.

Which gaps are you able to fill?

Insurers seeking to proactively scale back claims and enhance prevention must be fast to make the most of loss management applied sciences similar to Majesco’s Loss Management, knowledge and analytics with Majesco Property Intelligence or Majesco’s widely-acclaimed Clever Coverage for P&C. Insurers throughout all tiers and segments are leveraging Majesco options and dedication to relentless innovation to optimize their operation but additionally innovate. Our analysis supplies perception into our R&D and priorities to assist our prospects keep at the forefront.

“Majesco continues its market management place with their recognition as a Luminary within the Technical Functionality Matrix for Majesco Coverage for P&C,” stated Karlyn Carnahan, Head of Insurance coverage, North America at Celent. “The Luminary Award acknowledges these options which excel at each Superior Expertise and Breadth of Performance.

Carnahan provides, “Majesco Coverage for P&C is acknowledged as a pacesetter on this class as a powerful cloud SaaS answer, with intensive capabilities for private, business and specialty traces, wealthy API catalog, a “buyer panoramic view” which contains details about an current policyholder’s billing document and declare expertise, open to a broad ecosystem of third-party knowledge and performance companions, and pre-integration with Majesco’s “property intelligence rating” (offering a number of measures of dangers) and loss management survey capabilities.”

For extra info on how Majesco helps purchasers to develop extra aggressive day-after-day, contact us. To evaluate how your strategic priorities align with different insurers’ strategic priorities, you should definitely obtain Recreation Altering Strategic Priorities Redefining Market Leaders.

[i] Yelp Information Reveals Nationwide Splurging on Eating places and a Rising Curiosity in Positive Eating as New Restaurant Openings Improve, YelpEconomicAverage.com, June 21, 2023

[ii] “Dwelling Costs Spiked In Practically All Metro Areas In 3Q 2021,” Nationwide Mortgage Skilled, NOV 12, 2021, https://nationalmortgageprofessional.com/information/home-prices-spiked-nearly-all-metro-areas-3q-2021

[iii] Wilkinson, Claire, “Property insurance coverage charges to maintain surging in 2023,” Enterprise Insurance coverage, January 10, 2023, https://www.businessinsurance.com/article/20230110/NEWS06/912354781/Property-insurance-rates-to-keep-surging-in-2023