Everybody is aware of the purpose of placing cash right into a Roth IRA is that withdrawals are tax-free. That’s true at a excessive stage but it surely isn’t that easy if you go one stage down into the main points. Withdrawals from a Roth IRA observe a set of complicated guidelines to find out how a lot of a withdrawal is tax-free and penalty-free.

Roth IRA Withdrawal Guidelines

The foundations require that you just perceive regular contributions and conversions together with backdoor Roth and mega backdoor Roth, rollovers from Roth 401k to Roth IRA, a 5-year clock on every conversion, the taxable and non-taxable quantity within the conversion, and earnings within the Roth account, and so on., and so on. Gathering and conserving information to place greenback quantities into every bucket 12 months by 12 months requires one other stage of consideration. See Keep a Roth IRA Contributions and Withdrawals Spreadsheet.

Aid After 59-1/2

The good information is that each one these complexities go away if you’re 59-1/2. You solely must reply this one query if you withdraw out of your Roth IRA after age 59-1/2:

Did you’ve gotten a Roth IRA no less than 5 years in the past?

The reply is clearly “Sure” for most individuals. It’s the only option to make your Roth IRA withdrawal 100% tax-free. That’s the trail I’m aiming for.

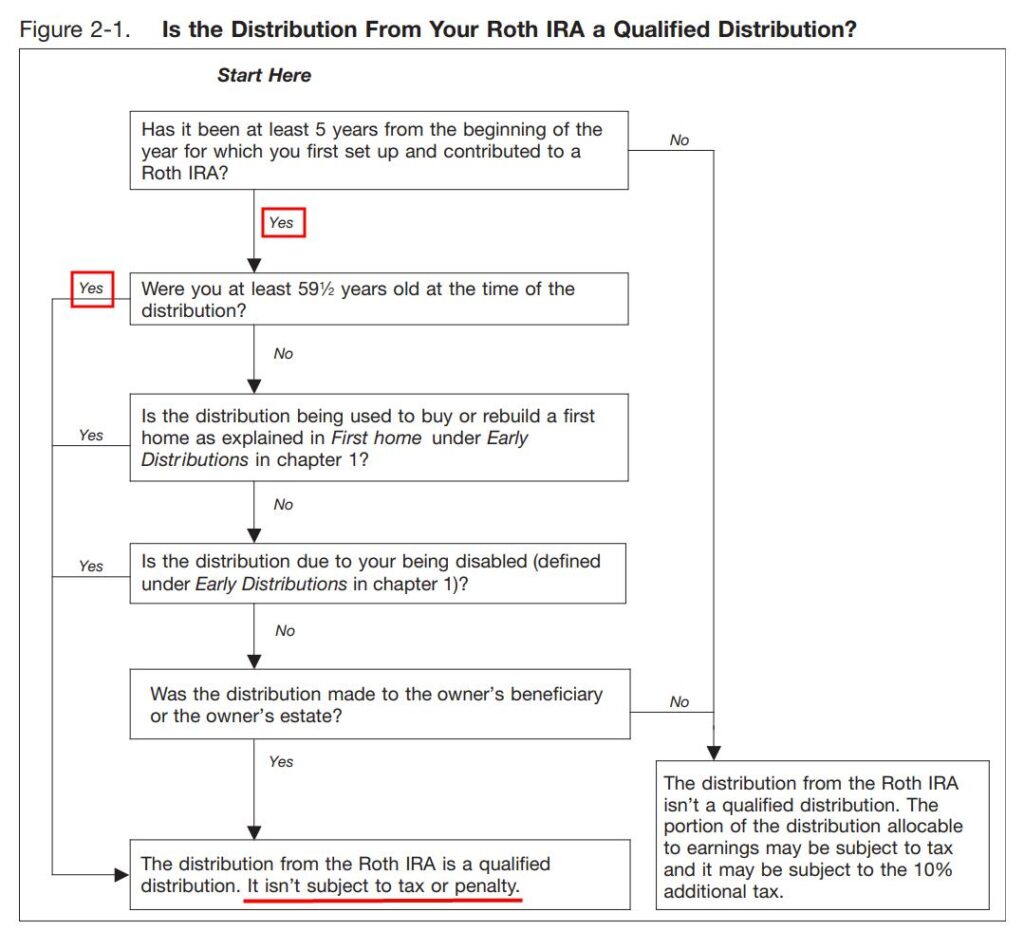

If you happen to can’t imagine that it’s this straightforward when you’re age 59-1/2, have a look at this circulate chart from the IRS:

Supply: IRS Publication 590-B, Determine 2-1.

You solely must have had a Roth IRA no less than 5 years in the past. The 5 years will not be tracked account-by-account or custodian-by-custodian. Your first Roth IRA doesn’t need to nonetheless exist. You solely must have some proof that it as soon as existed.

You’ll get a 1099-R out of your Roth IRA custodian within the following 12 months after you’re taking a withdrawal. Let’s have a look at the way it works in your tax return if you use tax software program TurboTax and H&R Block.

H&R Block

I usually begin with TurboTax once I do these tax software program walkthroughs however I’m beginning with H&R Block this time for causes that can develop into obvious later.

The screenshots under are from H&R Block Deluxe downloaded software program. The downloaded software program is each inexpensive and extra highly effective than the net model. You should buy H&R Block downloaded software program from Amazon, Walmart, Newegg, Workplace Depot, and lots of different retailers.

I began the tax return with a 67-year-old single taxpayer.

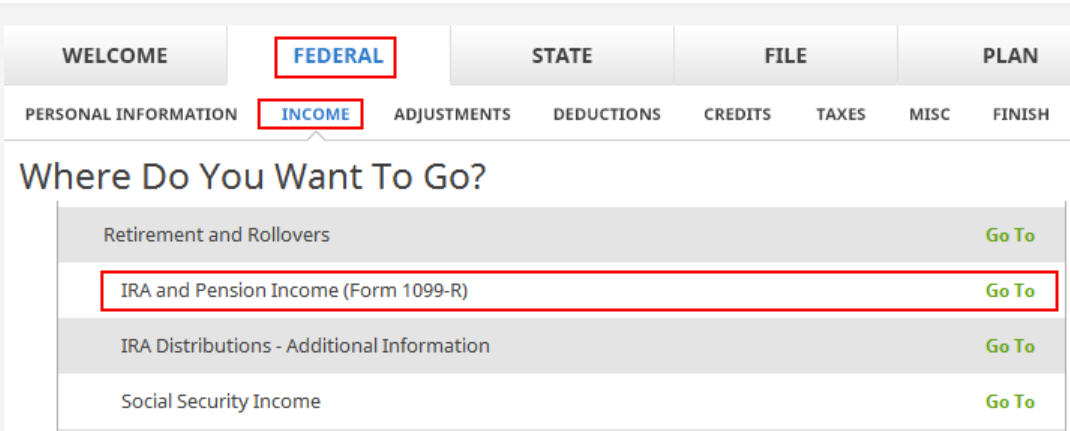

Go to Federal -> Earnings -> IRA and Pension Earnings (Kind 1099-R). You possibly can import the 1099-R or enter it manually. I’m displaying guide entries.

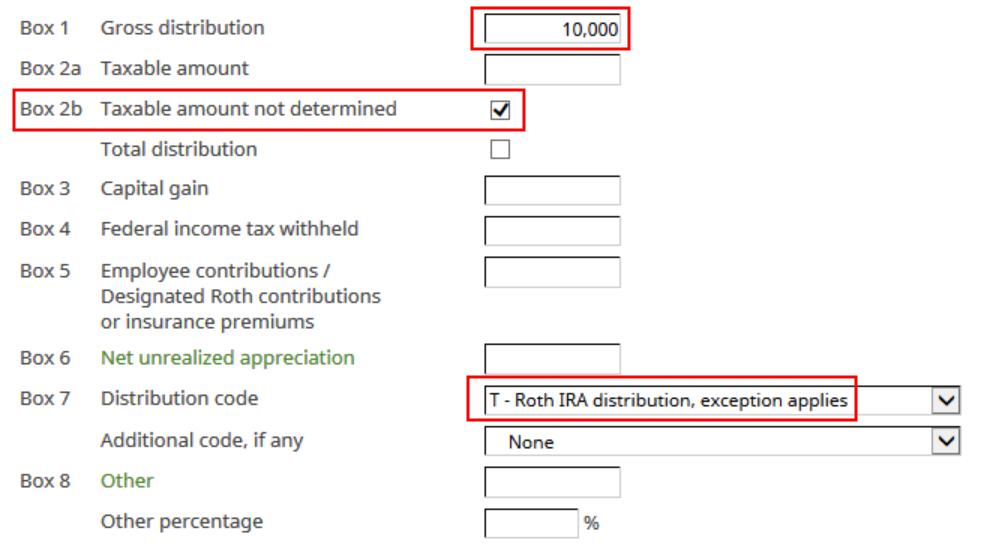

My check 1099-R is a traditional 1099-R. Enter the numbers out of your 1099-R as-is. It seems like this for a $10,000 withdrawal from the Roth IRA:

The quantity of the withdrawal reveals up in Field 1. Yours might have the identical quantity repeated in Field 2a and that’s OK too. It’s vital to have a checkmark in Field 2b “Taxable quantity not decided.” Your Roth IRA custodian isn’t figuring out whether or not your distribution is taxable. The field 7 distribution code is “T.”

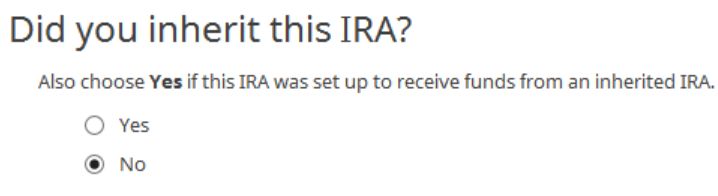

I didn’t inherit it.

Right here it’s asking whether or not I had my first Roth IRA no less than 5 years in the past. After all I did.

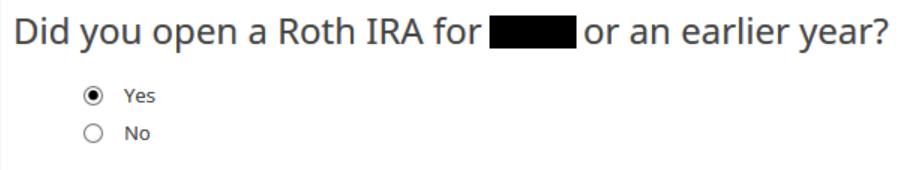

That’s it. It’s tax-free after I reply simply two easy questions. I didn’t have to present any element for the previous contributions, recharacterizations, conversions, rollovers, or distributions. It doesn’t matter how the cash acquired into the Roth IRA or when.

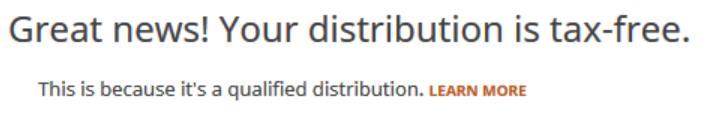

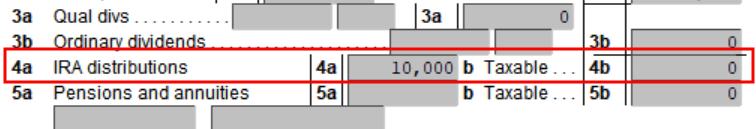

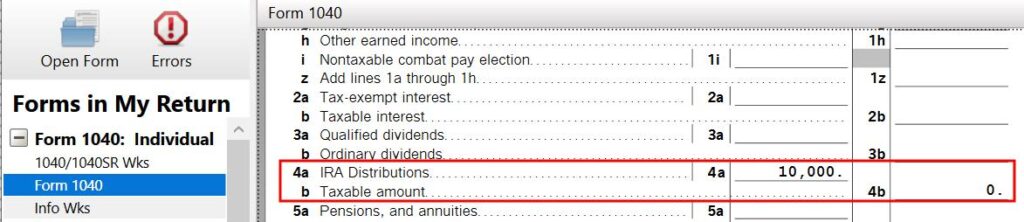

We will see how this reveals up on the tax type. Click on on Kinds on the highest and open Kind 1040 and Schedules 1-3. Click on on Disguise Mini WS. Scroll right down to traces 4a and 4b.

It reveals the withdrawal on Line 4a and nil on Line 4b. Line 4b is the taxable quantity. A zero there means it’s tax-free. When you have different IRA distributions equivalent to RMDs on Strains 4a and 4b, this tax-free withdrawal out of your Roth IRA provides to your different distributions on Line 4a but it surely doesn’t add to the taxable quantity on Line 4b.

TurboTax

Now let’s have a look at the way it works in TurboTax. The screenshots under are from TurboTax Deluxe downloaded software program. The downloaded software program is manner higher than on-line software program. If you happen to haven’t paid on your TurboTax On-line submitting but, you should purchase TurboTax obtain from Amazon, Costco, Walmart, and lots of different locations and change from TurboTax On-line to TurboTax obtain (see directions for find out how to make the change from TurboTax).

I began the tax return with a 67-year-old single taxpayer.

Go to Federal Taxes -> Wages & Earnings -> IRA, 401(okay), Pension Plan Withdrawals (1099-R). Import the 1099-R if you happen to’d like. I’m selecting to kind it myself.

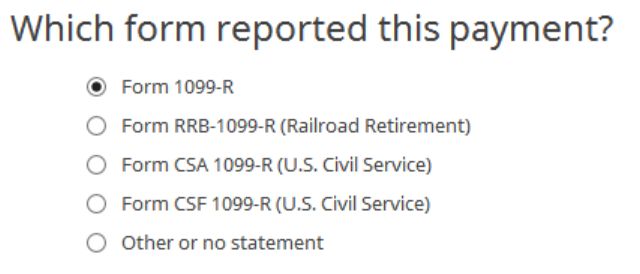

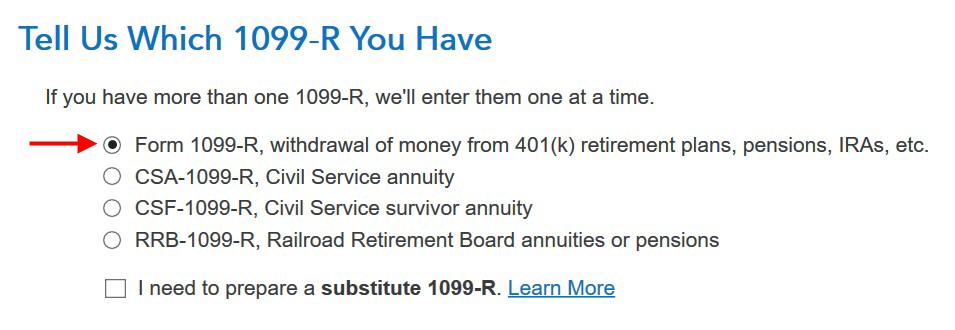

Simply the common 1099-R.

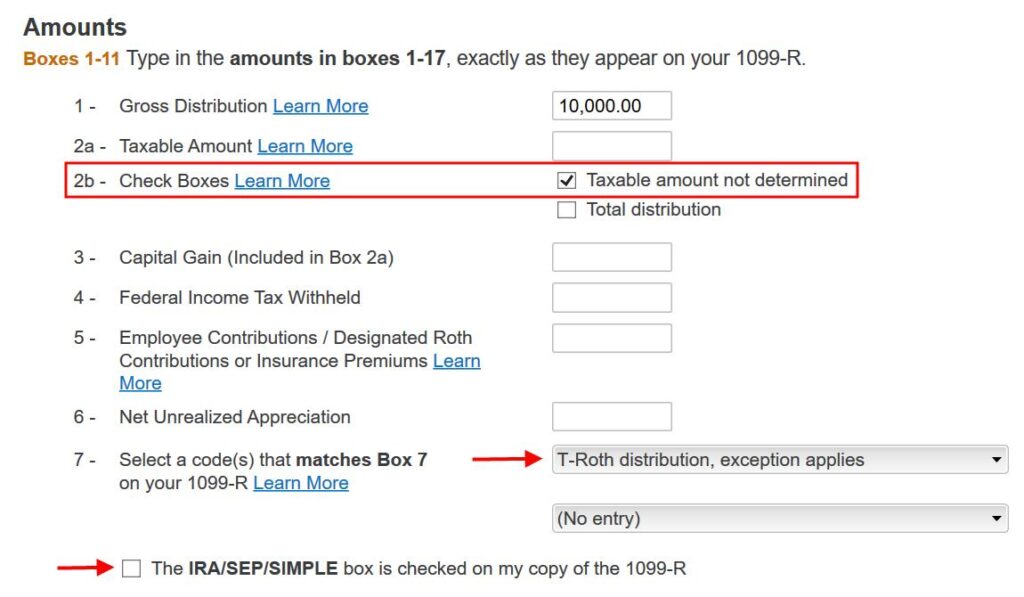

Field 1 reveals the quantity taken out of the Roth IRA. You could have the identical quantity copied because the taxable quantity in Field 2a. That’s OK when Field 2b is checked saying “taxable quantity not decided.” Take note of the code in Field 7. Be sure your entry matches your 1099-R precisely. I’ve a code “T” in my check 1099-R. The IRA/SEP/SIMPLE field will not be checked as a result of it’s from a Roth IRA.

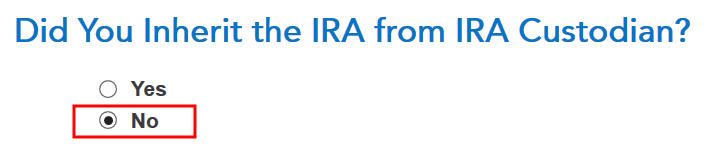

I didn’t inherit it.

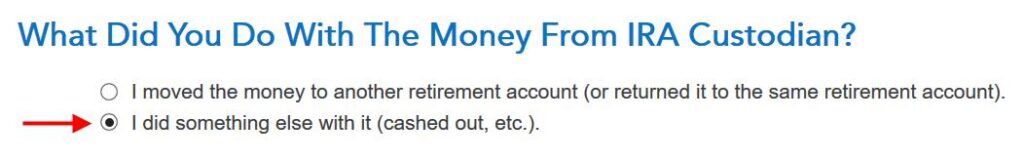

I didn’t transfer the cash to a different retirement account.

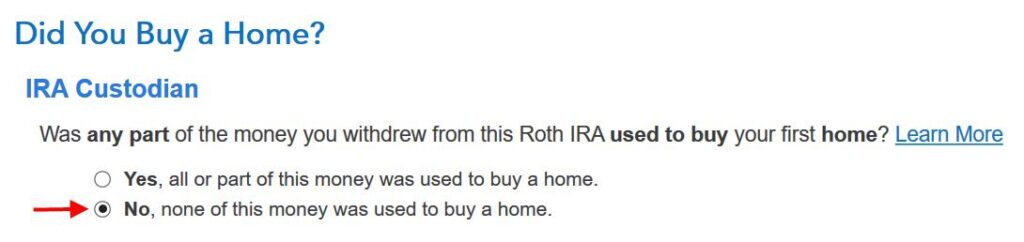

I didn’t purchase a house.

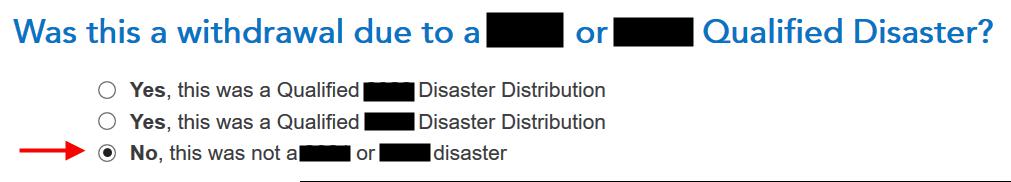

It wasn’t attributable to a catastrophe. I took the cash out and spent it.

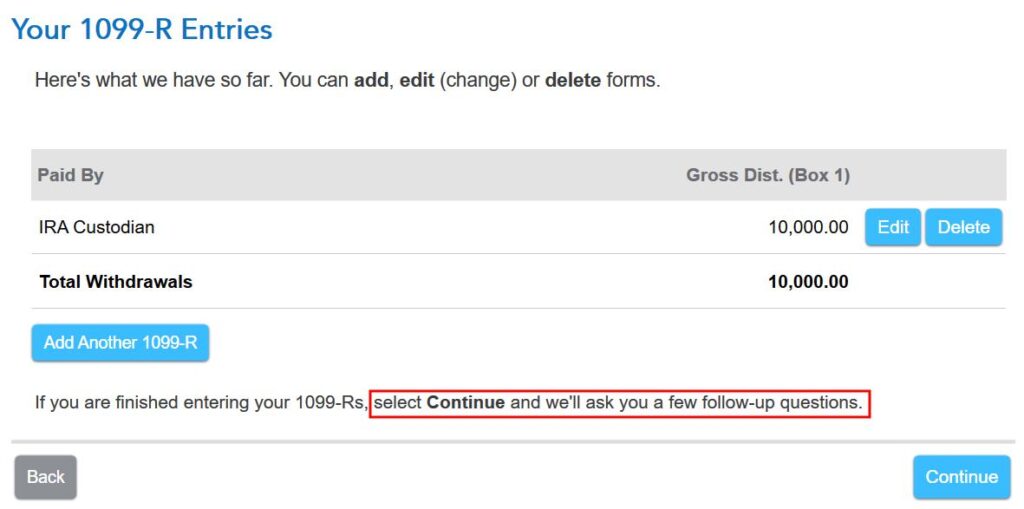

We come to this 1099-R abstract however we’re not executed but. TurboTax will ask extra follow-up questions.

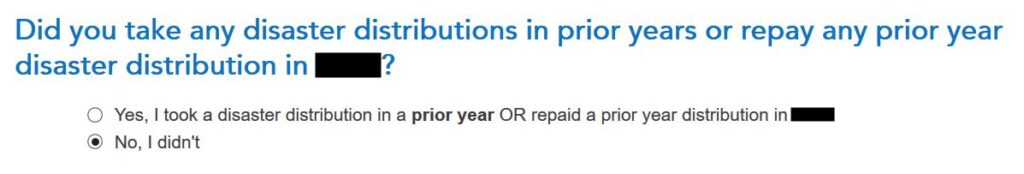

I didn’t take catastrophe distributions or repay them.

That is essentially the most related query. Sure, I owned a Roth IRA for no less than 5 years.

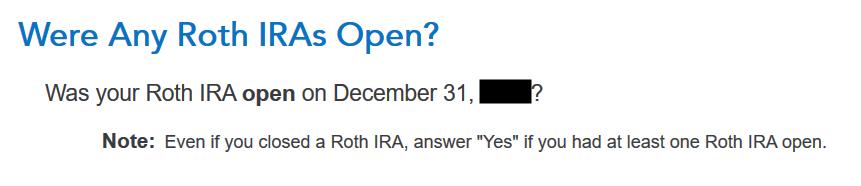

I don’t know why it issues whether or not I’ve an open Roth IRA however no matter.

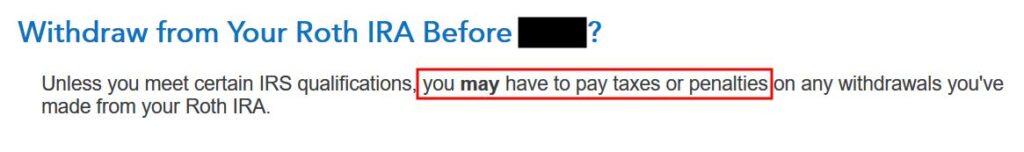

Now TurboTax is making an attempt to scare us. Why does it matter? I’m already 59-1/2!

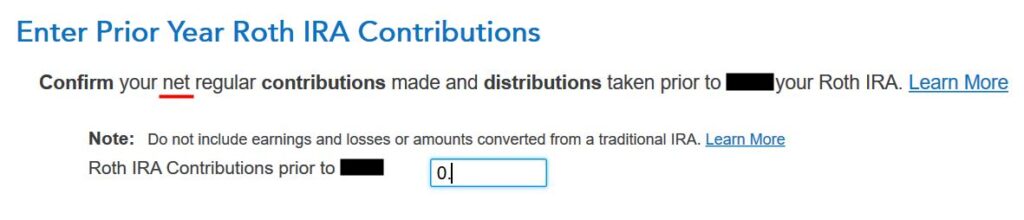

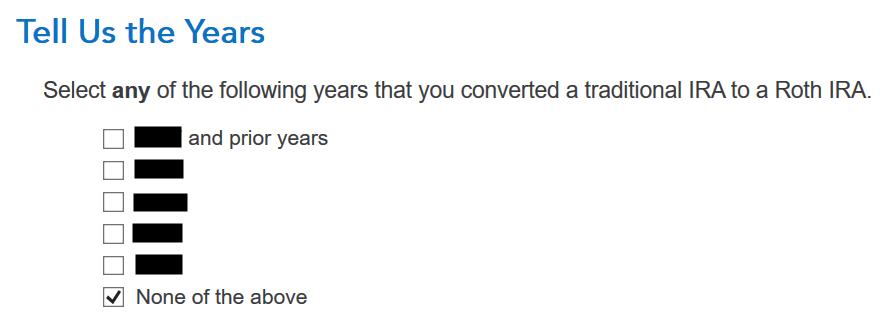

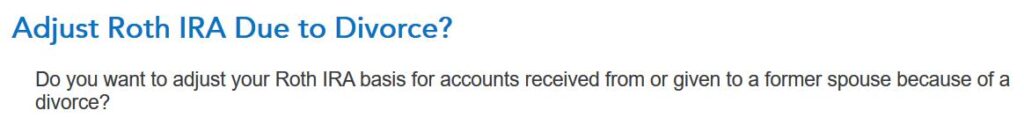

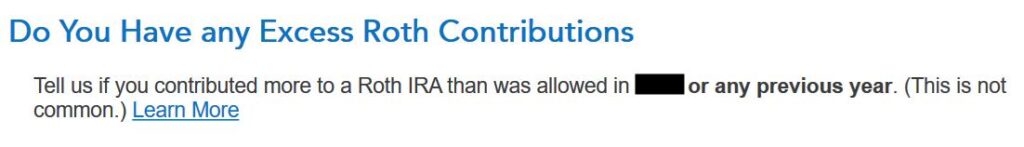

Now TurboTax will undergo the rigmarole of Roth IRA distribution ordering guidelines, that are irrelevant if you’re already 59-1/2 and also you had your Roth IRA for no less than 5 years. I’m going to misinform TurboTax now as a result of I do know the solutions simply don’t matter at this level.

If you happen to reply honestly which 12 months you probably did a Roth conversion, TurboTax will take you thru the main points of your prior conversions. You’ll waste time doing plenty of pointless work. So don’t cooperate.

Once more, irrelevant.

No extra contributions.

TurboTax is lastly executed with its irrelevant questions. Are you taxed on the withdrawal out of your Roth IRA? Click on on Kinds on the highest proper.

Discover Kind 1040 within the left navigation panel. Scroll up or down on the proper to search out traces 4a and 4b.

It reveals the withdrawal quantity on Line 4a and nil on Line 4b. A zero on Line 4b means it’s tax-free. When you have different IRA distributions equivalent to RMDs on Strains 4a and 4b, this Roth IRA withdrawal provides to your different distributions on Line 4a but it surely doesn’t add to the taxable quantity on Line 4b.

TurboTax arrives on the similar outcomes as H&R Block but it surely takes such an extended and pointless journey. It makes use of a one-size-fits-all method that doesn’t distinguish by whether or not you’re 59-1/2 or not.

No Roth IRA?

Nothing issues if you’re already 59-1/2 and also you had your first Roth IRA no less than 5 years in the past. All of your withdrawals from the Roth IRA are tax-free, finish of story. You received’t have to supply some other knowledge or information. So don’t suppose you should meticulously preserve every little thing. Simply save one assertion from a Roth IRA to point out that you just had it open no less than 5 years in the past.

This implies if you happen to don’t have a Roth IRA now, it’s best to convert $100 to Roth to plant a seed. You’ll get the 5-year clock began for the massive reduction if you’re 59-1/2.

The “I” in IRA stands for Particular person. Whether or not you’ve had a Roth IRA for 5 years is evaluated on a person foundation. If you’re married, it doesn’t matter how previous your partner is or how lengthy your partner has had a Roth IRA. It is advisable have had a Roth IRA in your personal identify for no less than 5 years if you withdraw out of your Roth IRA after age 59-1/2.

Not But 59-1/2?

It’s an entire totally different story if you happen to’re planning to withdraw out of your Roth IRA earlier than age 59-1/2. You do want detailed information to reply these questions from TurboTax. You need to use one thing just like the spreadsheet I included in Keep a Roth IRA Contributions and Withdrawals Spreadsheet.

To be sincere, I gave up on conserving monitor of Roth IRA contributions, recharacterizations, conversions, rollovers, and distributions. I’ll take the straightforward path and wait till the 12 months I’m 59-1/2.

Say No To Administration Charges

If you’re paying an advisor a proportion of your property, you’re paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.