SPX Monitoring functions; Brief SPX on 9/1/23 at 4515.77; cowl quick 9/5/23 at 4496.83 = achieve .43%.

Acquire Since 12/20/22: 15.93%.

Monitoring Functions GOLD: Lengthy GDX on 10/9/20 at 40.78. Chart 1

This week is the weakest week of the 12 months, in accordance with seasonality.

The highest window above is the SPY. We labeled the occasions in blue when the TRIN and TICK closed in panic ranges. Panic solely seems at bottoms available in the market; no panic readings, no backside. Panic additionally happens close to the identical value ranges. We shaded in mild blue when panic TRIN and TICK closes occurred, and that appeared between the 435 to 445 SPY ranges. Its seems the SPY is constructing a base from 435 to 445 SPY vary for one more rally to start from. The SPY could take a look at the decrease vary of this degree yet one more time earlier than the subsequent impulse wave up begins.

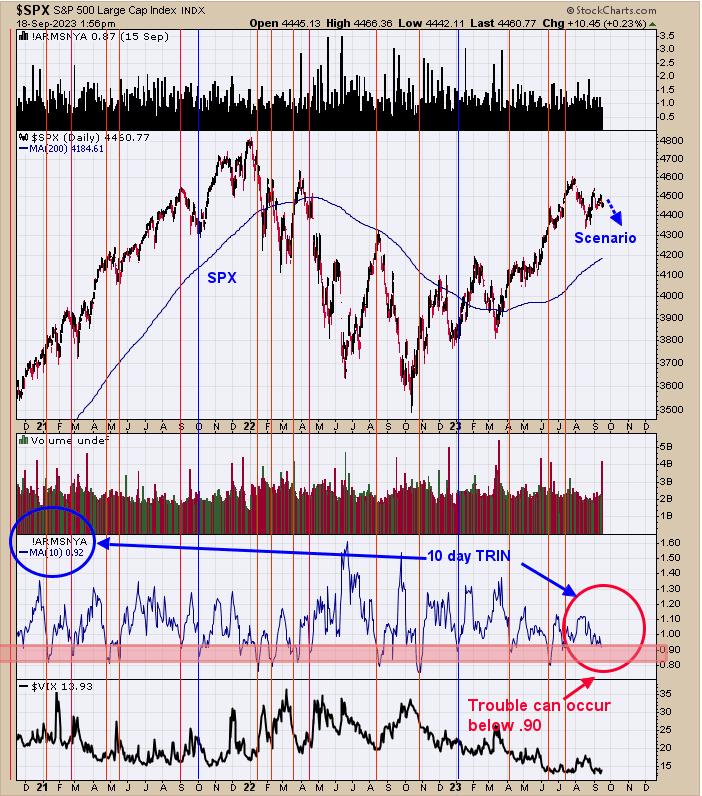

The chart seems on the larger image. The second window up from the underside is the 10-day common of the TRIN closes. It is common for the market to stall, if not decline, when the 10-day TRIN reaches .90 and decrease. We marked the occasions with crimson strains the occasions when the ten day TRIN reached .90 and decrease. Presently, the 10-day TRIN stands at .92, which leans bearish. A ten-day TRIN above 1.20 is generally discovered close to lows available in the market, and is one thing that will seem within the coming weeks when the subsequent main low is approached. We predict a year-end rally, and that will come when the 10-day TRIN reaches above 1.20.

Tim Ord,

Editor

www.ord-oracle.com. Guide launch “The Secret Science of Worth and Quantity” by Timothy Ord, purchase at www.Amazon.com.

Indicators are offered as common data solely and aren’t funding suggestions. You’re accountable for your personal funding selections. Previous efficiency doesn’t assure future efficiency. Opinions are primarily based on historic analysis and knowledge believed dependable; there isn’t any assure outcomes will likely be worthwhile. Not accountable for errors or omissions. I could put money into the autos talked about above.