KEY

TAKEAWAYS

- Though September is taken into account a seasonally weak interval for the inventory market the fourth quarter is often a robust interval

- There is a excessive likelihood of the S&P 500 Index reaching a brand new excessive in This autumn

- Progress shares, Industrials, Financials, and Commodities may all see optimistic motion in This autumn

Merchants and buyers do not usually stay up for September. Apart from being the top of summer season holidays and back-to-school season, the inventory market often hits its weakest level right now of the 12 months. However that does not essentially imply you must avoid the inventory market in September.

In the event you patiently watch for the pullback to unravel, it may current funding alternatives for the final quarter of the 12 months. And provided that 2023 is a pre-election 12 months, it is often a robust one for equities. However which market phase must you spend money on, and which of them must you avoid?

In a current StockCharts TV episode of Charting Ahead, recorded on September 12, 2023, Chief Market Strategist of StockCharts.com, David Keller, CMT, spoke with the next three technical analyst veterans:

- Mish Schneider, Director of Buying and selling Schooling at Market Gauge

- Tom Bowley, Chief Market Strategist of EarningsBeats.com

- Julius de Kempenaer, Creator of Relative Rotation GraphsⓇ and Senior Analyst at StockCharts.com

In it, the group mentioned how the broader market went by a pullback in August, however has since recovered. Given September is taken into account a weak month, does that imply the inventory market may see one other pullback earlier than transferring again up? Which areas of the market are prone to carry out properly, and which of them are prone to be the laggards in This autumn? Let’s discover out.

“I am not as bearish as I ought to be. The chance elements we take a look at say “risk-on” is the best way to go.” —Mish Schneider

So, assuming nothing out of the abnormal occurs, Mish’s outlook is optimistic. The inventory market has remained robust regardless of rising rates of interest, inflationary pressures, and rising oil costs. When the inventory market is trending greater, there is no cause to battle that pattern.

“We’re in the summertime doldrums and will see yet one more drop earlier than going greater. However I am additionally bullish.” —Tom Bowley

Earlier within the 12 months—mid-July—sentiment indicators confirmed bearish indicators, and a few destructive divergences had been rising within the broader indexes. However that has reversed.

“In the event you take a look at a day by day chart of the S&P 500 ($SPX), there’s a sequence of upper highs and better lows because the August pullback. I would not be shocked if the S&P 500 exceeds 4600 in This autumn.” —Julius de Kempenaer

Effectively, you may’t argue there. The best way issues are actually (wanting systematic threat hitting the market), the inventory market appears to be hanging in there. It is virtually as if it is ready for a catalyst to push it greater.

The pullback of the Magnificent Seven shares was wholesome and maybe a much-needed one. Apple (ticker image: AAPL) hit a tough patch when China restricted using the iPhone. However should you take a look at a day by day chart of AAPL (see under), it does not paint a doom-and-gloom image.

CHART 1: DAILY CHART OF APPLE, INC. Though Apple’s inventory value confronted some strain, it nonetheless did not take out its August low.Chart supply: StockCharts.com. For academic functions.

The inventory hasn’t taken out its August 18 low of $172 and will doubtlessly reverse. If a hard-hit inventory is not trying bearish, is there any cause for buyers to query the energy of the fairness market?

What Might Go Incorrect

For Mish, it might be the retail house. Shopper habits is strongly correlated with the well being of the US economic system. And if customers reduce on their spending, which is feasible when inflationary pressures are ubiquitous and rates of interest are excessive, it may add some stress to the broader market.

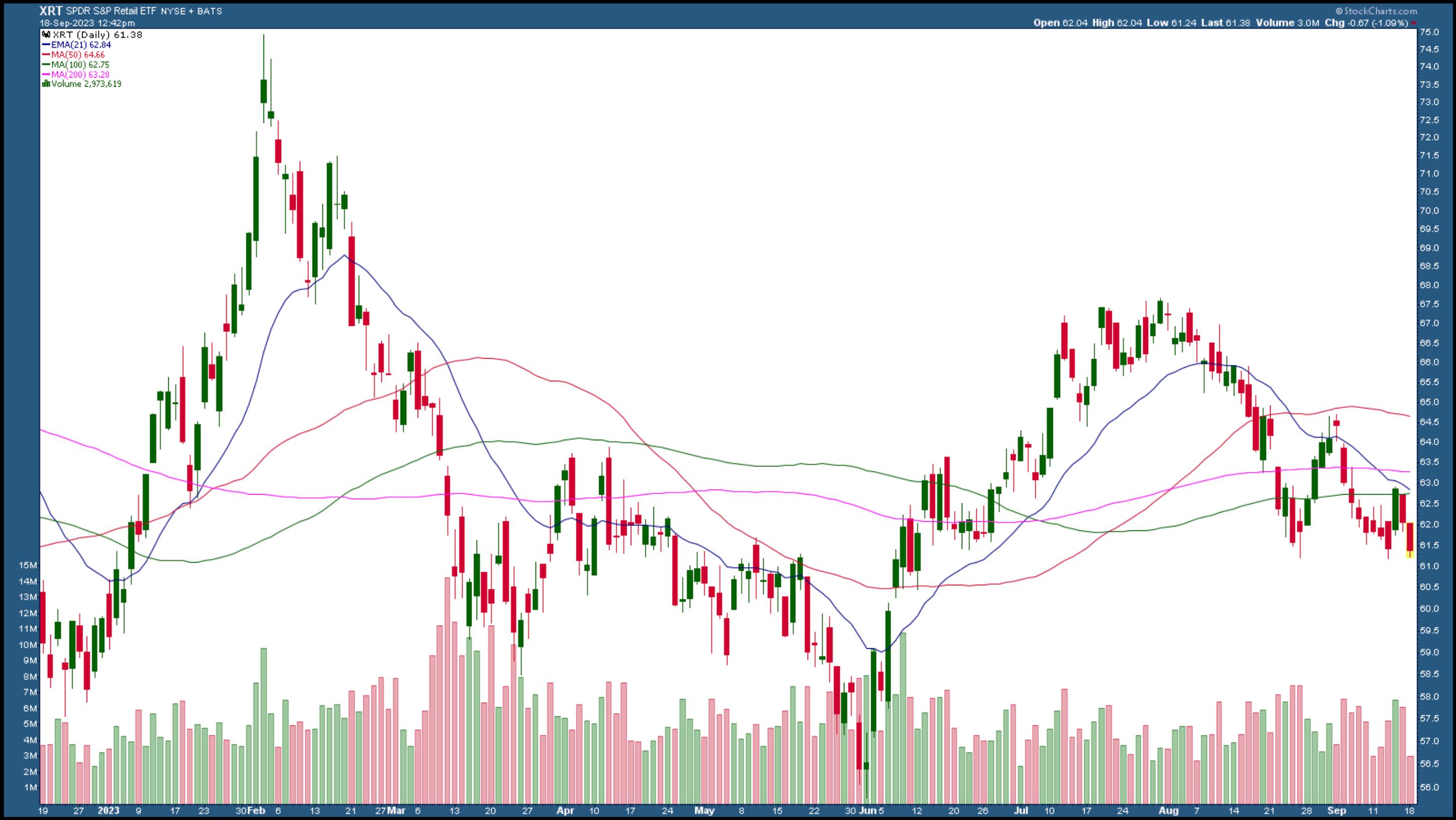

Up to now, there aren’t any indicators of a drop in retail gross sales. August retail gross sales had been up 0.6% month over month—greater than the 0.1% improve anticipated by economists. A big a part of that rise might be attributed to greater gasoline costs. In the event you strip away auto and gasoline from the info, retail gross sales rose by a mere 0.2%. This might point out that buyers could face strain, so it is best to keep watch over the retail sector by carefully watching the SPDR S&P Retail ETF (XRT).

CHART 2: THE RETAIL SECTOR HELPS GAUGE CONSUMER SENTIMENT. The August excessive did not come near its February excessive. Does that imply retail spending may decline within the close to future?Chart supply: StockCharts.com. For academic functions.

One attention-grabbing level Mish made was that the uptrend in XRT from June to July (2023) did not come near the February 2023 excessive. And although XRT noticed a bounce as a result of optimistic retail gross sales quantity, there is no signal of an uptrend—greater highs and better lows.

Rising oil costs may put strain on the fairness market. Whereas vitality shares are rising, Julius factors out that different sectors, akin to Shopper Discretionary, Know-how, and Communication Companies, are on the point of achieve energy. It is seemingly the Magnificent Seven will take the lead once more, which is encouraging, provided that the Vitality sector is trying overbought.

Sector Relationships Are Essential

Relationships between sectors typically maintain the important thing to future market motion. Tom Bowley pays shut consideration to the relationships for warning indicators. What you hear within the media could not seem on the charts. So, what are the charts indicating?

“Along with Shopper Discretionary and Know-how, Industrials and Financials are inclined to carry out properly throughout This autumn,” stated Tom. So keep watch over the chart of the Industrial Choose Sector SPDR Fund (XLI) and the Monetary Choose Sector SPDR (XLF). The day by day chart of XLF under reveals the ETF bouncing off its 50-day easy transferring common.

CHART 3: DAILY CHART OF THE FINANCIAL SELECT SECTOR SPDR (XLF). The Monetary sector may carry out properly in This autumn. The ETF seems to be bouncing off its 50-day easy transferring common.Chart supply: StockCharts.com. For academic functions.

One other sector to look at is Supplies. Apart from manufacturing cuts, Mish feels that the rise in oil costs has to do with shortages. Due to this, we may see a increase in commodities. “Commodities have began to backside and are choosing up steam,” added Julius.

Many say, “This time, it is completely different.” And there is some fact to that. When contemplating shopping for a inventory, there are various elements to investigate. For instance, we’re in a high-interest charge surroundings, which usually hurts development shares. However we have not seen that.

“Rates of interest are just one a part of the equation,” talked about Tom. So, if development is powerful, you may count on development shares to proceed rising.

The Backside Line

So all three analysts had an analogous opinion of the general path of the broader market. Nevertheless, every had distinctive views of their evaluation. For extra insights on cryptocurrencies, sectors prone to outperform or underperform, and which shares or charts to look at in This autumn, take a look at the video (hyperlink on the backside of this text).

We’re approaching the second half of September, which is often the worst a part of the month. However the broader indexes are exhibiting bullish indicators. Even hotter-than-expected inflation numbers did not spark a selloff. There’s nonetheless a Fed assembly later this month, however the probabilities of Fed Chairman Powell making any feedback which will trigger the market to sway considerably in both path are slim. Will September’s efficiency be completely different this 12 months?