KEY

TAKEAWAYS

- Development-Worth Rotating Again in Favor of Development

- Massive-Cap shares selecting up Power Over Mid- and Small-cap segments

- Therefore, Massive-Cap Development Stands out Positively

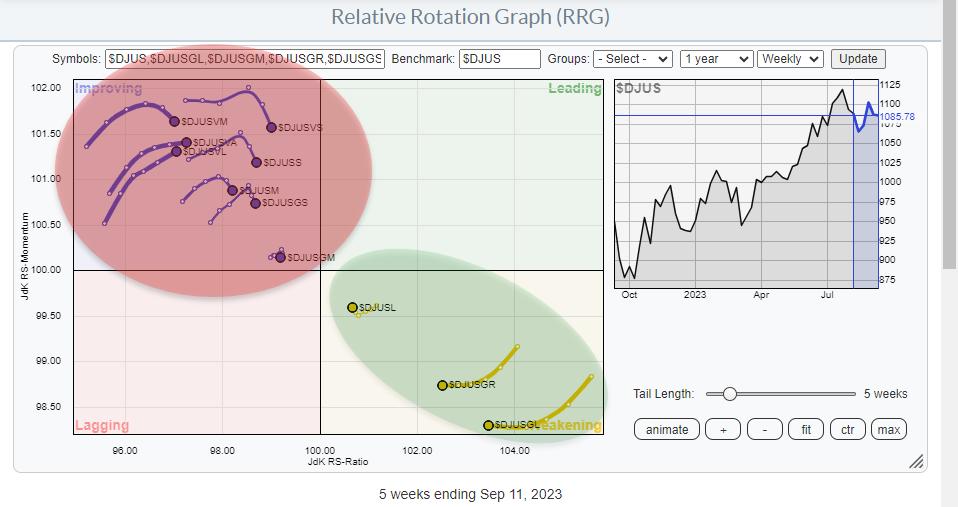

RRG sending a transparent message

The Relative Rotation Graph above exhibits the rotation for the mixed Measurement and Development/Worth segments out there.

And the message is fairly clear.

To start with, there are NO tails contained in the leading- and no tails contained in the lagging quadrant. That means {that a} large rotation is underway. This statement is supported by the second statement. That is the truth that all blue tails contained in the enhancing quadrant are within the means of rolling over. On the other facet, the orange tails contained in the weakening quadrant are all (three of them) beginning to curl again up, or near it.

We all know that rotations that full on both the right- or the left-hand facet of the RRG are attribute of a really sturdy relative up- or downtrend. And that appears to be the case for the time being.

Development vs. Worth

After we break down this universe into its development and worth segments we are able to see the remoted rotations for development vs. worth. After a counter-trend transfer with worth selecting up relative momentum and development dropping relative momentum, these tails at the moment are beginning to roll again up/down. Given the present distance from the 100 degree on the RS-Ratio scale, development on the optimistic facet, and worth on the detrimental facet, there may be sufficient “room” for the market to proceed its rotation within the present path. That may convey development again up in direction of the main quadrant and push worth again into the lagging quadrant.

After we break down this universe into its development and worth segments we are able to see the remoted rotations for development vs. worth. After a counter-trend transfer with worth selecting up relative momentum and development dropping relative momentum, these tails at the moment are beginning to roll again up/down. Given the present distance from the 100 degree on the RS-Ratio scale, development on the optimistic facet, and worth on the detrimental facet, there may be sufficient “room” for the market to proceed its rotation within the present path. That may convey development again up in direction of the main quadrant and push worth again into the lagging quadrant.

Massive-Mid-Small

After we do the identical for the dimensions section, once more we see that rotation, remoted, and magnified.

Mid- and small caps are contained in the enhancing quadrant and beginning to roll over and transfer again all the way down to lagging. Massive caps are contained in the weakening quadrant and have already began to curve again up and transfer towards the main quadrant.

Merging these two RRGs offers us the RRG on the high of this text which sends a reasonably clear message, pointing to Massive-Cap-Development as the very best section out there in the intervening time.

US Massive-Cap Development

The worth chart for US Massive Cap Shares ($DJUSGL) remains to be effectively inside the boundaries of its rising development channel. Three weeks in the past $DJUSGL examined horizontal resistance close to 5780. This degree has been in play since September 2021 and confirmed up as both help or resistance a number of occasions which makes it a degree to observe.

As soon as this barrier might be cleared, new upside potential might be unlocked, concentrating on the all-time excessive ranges which had been set on the finish of 2021 round 6100 giving us a 5.5% upside potential.

From a relative perspective, uncooked RS is transferring sideways after a pleasant run-up for the reason that begin of the 12 months. This consolidation is inflicting the RRG-Strains to drop again and produce RS-Ratio down from its highest degree over the past three years. With RS-Momentum under 100 however already leveling off and able to begin transferring greater, this positions the tail for $DJUSGL contained in the weakening quadrant and curling again up. Prepared to finish a rotation on the right-hand facet of the RRG, as we all know one of many strongest setups and the beginning of a brand new up-leg in an already rising (relative) development.

#StayAlert and have an incredible week, –Julius

Sunday/Monday I might be touring again from Redmond, WA to Amsterdam. So a brand new episode of Sector Highlight might be recorded later within the week.

Julius de Kempenaer

Senior Technical Analyst, StockCharts.com

Creator, Relative Rotation Graphs

Founder, RRG Analysis

Host of: Sector Highlight

Please discover my handles for social media channels beneath the Bio under.

Suggestions, feedback or questions are welcome at Juliusdk@stockcharts.com. I can not promise to reply to each message, however I’ll actually learn them and, the place fairly attainable, use the suggestions and feedback or reply questions.

To debate RRG with me on S.C.A.N., tag me utilizing the deal with Julius_RRG.

RRG, Relative Rotation Graphs, JdK RS-Ratio, and JdK RS-Momentum are registered emblems of RRG Analysis.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This distinctive methodology to visualise relative energy inside a universe of securities was first launched on Bloomberg skilled companies terminals in January of 2011 and was launched on StockCharts.com in July of 2014.

After graduating from the Dutch Royal Navy Academy, Julius served within the Dutch Air Pressure in a number of officer ranks. He retired from the army as a captain in 1990 to enter the monetary business as a portfolio supervisor for Fairness & Regulation (now a part of AXA Funding Managers).

Study Extra