The USDZAR pair is perched close to the 19.00 stage, awaiting the South African CPI (Inflation) Report due on Wednesday, 20 September 2023, at 08:00 GMT. This report, a compass within the realm of economics, guarantees to unveil the intricate tapestry of inflation’s previous, current, and future and the way it casts its shadow over client welfare, financial exercise, financial coverage, and market actions.

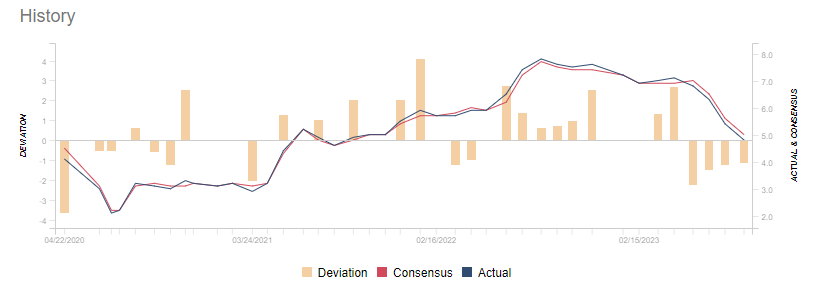

In keeping with consensus forecasts from analysts surveyed, we anticipate the annual inflation charge to stay at 4.8% in August. Concurrently, the month-to-month inflation charge is projected to ease to 0.4% in August, down from 0.9% in July. There are numerous elements affecting this outlook, together with gas costs, meals prices, the rand trade charge, and provide chain disruptions.

In keeping with consensus forecasts from analysts surveyed, we anticipate the annual inflation charge to stay at 4.8% in August. Concurrently, the month-to-month inflation charge is projected to ease to 0.4% in August, down from 0.9% in July. There are numerous elements affecting this outlook, together with gas costs, meals prices, the rand trade charge, and provide chain disruptions.

The upcoming inflation information is essential for the USDZAR pair because it influences the South African Reserve Financial institution (SARB). The SARB’s major objective is to maintain inflation inside the goal vary of three% to six%. Throughout its July 2023 assembly, the SARB maintained its key repo charge at a 14-year excessive of 8.25%, signalling a pause in its tightening cycle after 10 consecutive charge hikes. The SARB has hinted that it’ll solely increase its rate of interest if it sees sustained progress towards its inflation goal.

The upcoming inflation information is essential for the USDZAR pair because it influences the South African Reserve Financial institution (SARB). The SARB’s major objective is to maintain inflation inside the goal vary of three% to six%. Throughout its July 2023 assembly, the SARB maintained its key repo charge at a 14-year excessive of 8.25%, signalling a pause in its tightening cycle after 10 consecutive charge hikes. The SARB has hinted that it’ll solely increase its rate of interest if it sees sustained progress towards its inflation goal.

Ought to the inflation information align with or fall beneath expectations, it might sign decrease dwelling prices and elevated buying energy for shoppers. This might stimulate client spending, bolster financial development, and relieve strain on the SARB to lift rates of interest, benefiting the bond market and reducing borrowing prices. Nonetheless, a weaker Rand might consequence, doubtlessly lowering overseas investor curiosity in South African property and elevating future import prices and inflation.

In distinction, if the inflation information exceeds expectations, it might result in increased dwelling prices and lowered client buying energy. This might dampen client spending and financial development, growing the strain on the SARB to lift rates of interest, impacting the bond market and borrowing prices. On the constructive facet, a stronger Rand might appeal to overseas buyers and cut back future import prices and inflationary pressures.

Within the coming days, the USDZAR pair is prone to expertise volatility as buyers react to the inflation information’s implications for the South African economic system and monetary markets. The pair’s actions can even be influenced by elements reminiscent of US financial information, the Federal Reserve’s insurance policies, international sentiment, and technical ranges.

At present, the pair is buying and selling above the 50-day, 100-day, and 200-day shifting averages, suggesting a bullish pattern. Resistance lies forward on the 19.13 to 19.23 zone and the psychological stage of 19.00. A breach of those ranges might propel the pair in direction of 19.50 to 19.80. Conversely, a drop beneath 18.80 might open the door to additional losses in direction of 18.60.

Click on right here to entry our Financial Calendar

Francois du Plessis

Market Analyst

Disclaimer: This materials is offered as a common advertising communication for data functions solely and doesn’t represent an unbiased funding analysis. Nothing on this communication accommodates, or needs to be thought-about as containing, an funding recommendation or an funding advice or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency is just not a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of danger for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.