KEY

TAKEAWAYS

- Like a swiss military knife, the Ichimoku Kinko Hyo is a multi-purpose indicator that can be utilized to form your buying and selling setups and selections

- The Chikou Span, with its 26-day look-back, can be utilized to substantiate market sentiment and determine potential pattern reversals

- Whilst a retroactive characteristic, the Chikou Span can supply early buying and selling alerts, typically even previous different indicators

The Ichimoku Kinko Hyo (or Ichimoku for brief) is sort of a Swiss military knife of an indicator, designed for every part from projecting help and resistance to figuring out commerce alerts. It has 5 key elements that ought to be mixed to research present value motion whereas establishing future trades.

What makes the Ichimoku distinctive amongst indicators is its 26-day look-forward and look-back characteristic. It is kind of like driving: you possibly can’t simply transfer primarily based on what’s in entrance of you, it’s a must to scan your sides to see what’s occurring now, in addition to look behind you to see what it means to your deliberate maneuvers.

This text examines the 26-period look-back: the Chikou Span, or the “Lagging” Span.

Two Causes to Look Again 26 Days

When you can see what’s occurring now and have a possible setup for the long run, why look again? It appears a bit awkward, however there have to be some rationale past the Chikou Span’s perform.

Effectively, there are two:

- First, to measure (extra like “affirm”) market sentiment.

- Second, to sign potential pattern reversals, typically early on.

On this method, you possibly can have a look at present and future setups with the arrogance of seeing some type of affirmation primarily based on previous value motion. Let’s think about the primary cause: measuring market sentiment.

Measuring Market Sentiment with the Chikou Span

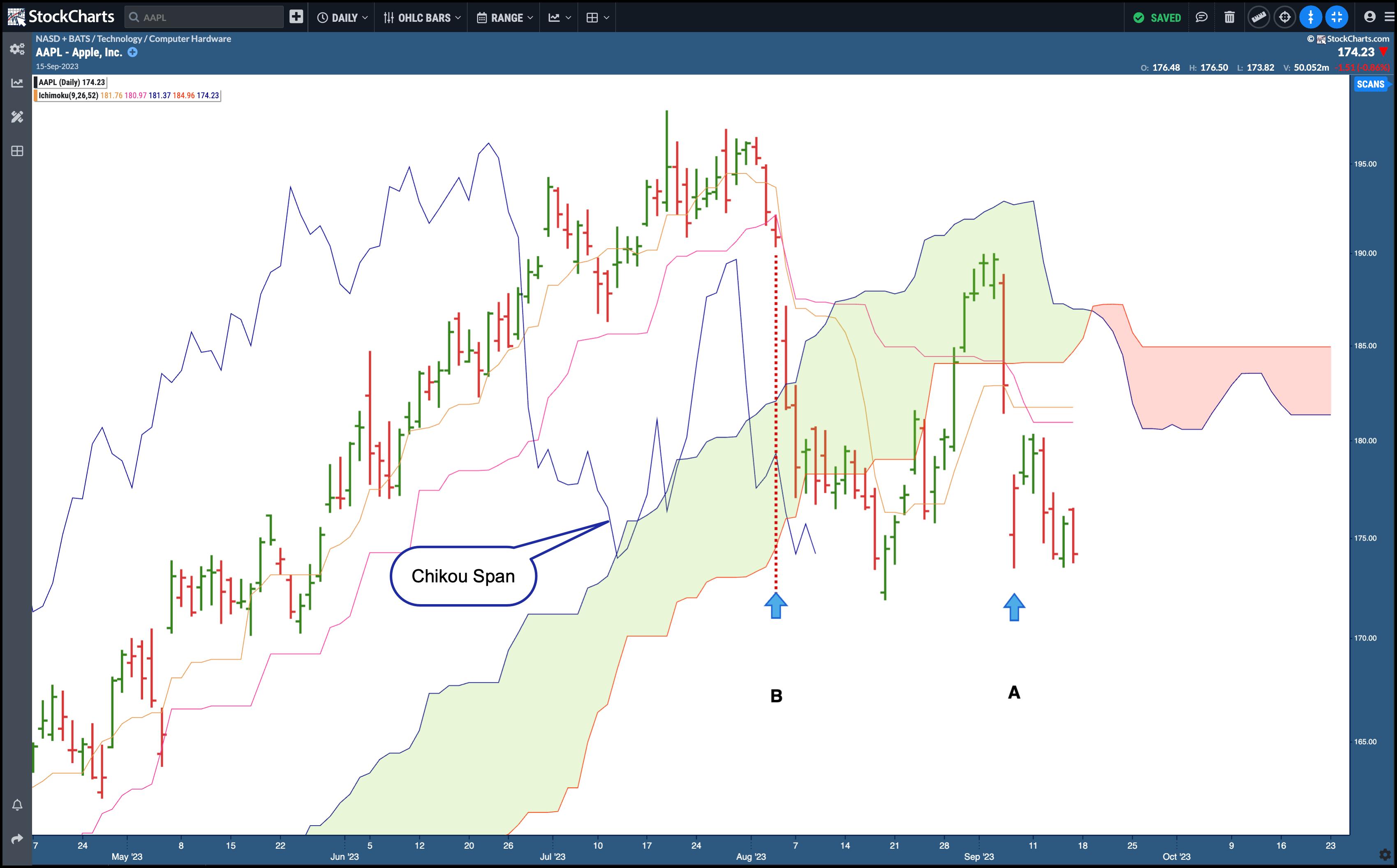

Check out the each day chart of Apple, Inc (AAPL) under:

CHART 1. APPLE INC (AAPL) AND ICHIMOKU INDICATOR WITH ALL COMPONENTS BUT THE CHIKOU SPAN DULLED OUT. This chart reveals that the Chikou Span is 26 days (or intervals) behind present costs.Chart supply: StockChartsACP. For instructional functions.

- The Chikou Span is displayed in blue.

- The arrow labeled A is the candle of focus.

- The arrow labeled B marks the place the Chikou Span was 26 days prior.

Now, observe that in B, the Chikou Span was effectively under the value 26 days prior. This means that sellers (or the proverbial “bears”) managed the market. And, after all, you realize this as a result of costs have fallen from the place they stood 26 days in the past.

So what is the worth in exhibiting and confirming what you already know? The worth of the Chikou Span is within the second of its crossover and can be utilized to determine pattern reversals.

Utilizing the Chikou Span to Establish Potential Development Reversals

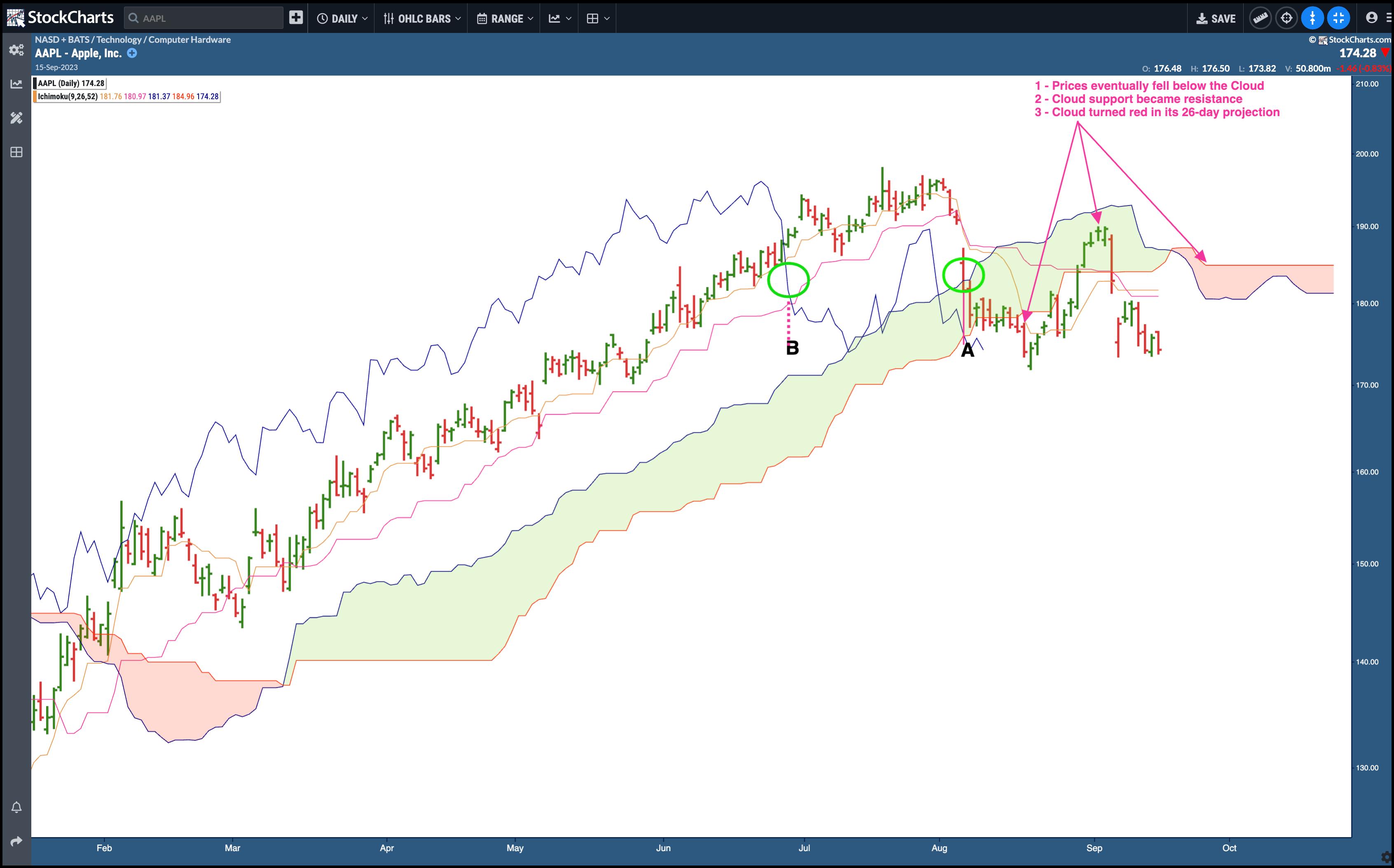

Let’s take a look at the identical chart, however return a number of intervals.

CHART 2. AAPL, CHIKOU SPAN, AND THE CLOUD (OR “KUMO”). The Chikou Span gave a bearish sign when it fell under previous costs, however it’s a must to have a look at different Ichimoku elements to get a extra correct learn on present and potential future value actions.Chart supply: StockChartsACP. For instructional functions.

Word the 2 inexperienced circles labeled A and B. When value gapped decrease at A, it coincided with the Chikou Span crossing under costs 26 days prior, as proven at B.

When the Chikou Span crossed under value and the Tenkan-sen (conversion line) and Kijun-sen (final analysis), it is thought-about a bearish indication. As you possibly can see, costs continued to fall. Nonetheless, value additionally falls into the Cloud (aka Kumo), typically seen as potential help.

So there are two conflicting alerts: a possible pattern reversal signaled by the crossovers, however doubtlessly bullish help within the cloud. Which one is it going to be, bullish or bearish? That is the place the nuances set in, and it is determined by the sort of dealer you might be and the way you employ the remainder of the Ichimoku elements.

- An aggressive dealer might need used the detrimental Chikou Span crossovers as a sign to go brief.

- A much less aggressive dealer would have waited for the Chikou Span to cross under the Cloud itself (which hasn’t but occurred).

Word the end result: Costs finally fell by means of the cloud, however discovered help. Nonetheless, upon re-entering the cloud, help grew to become resistance, and the cloud finally turned a bearish pink. What occurs subsequent is anybody’s guess. Whereas the aggressive strategy occurred upon a superb consequence, it wasn’t the “most secure” commerce to take. So, it is determined by your threat tolerance and strategy to the markets.

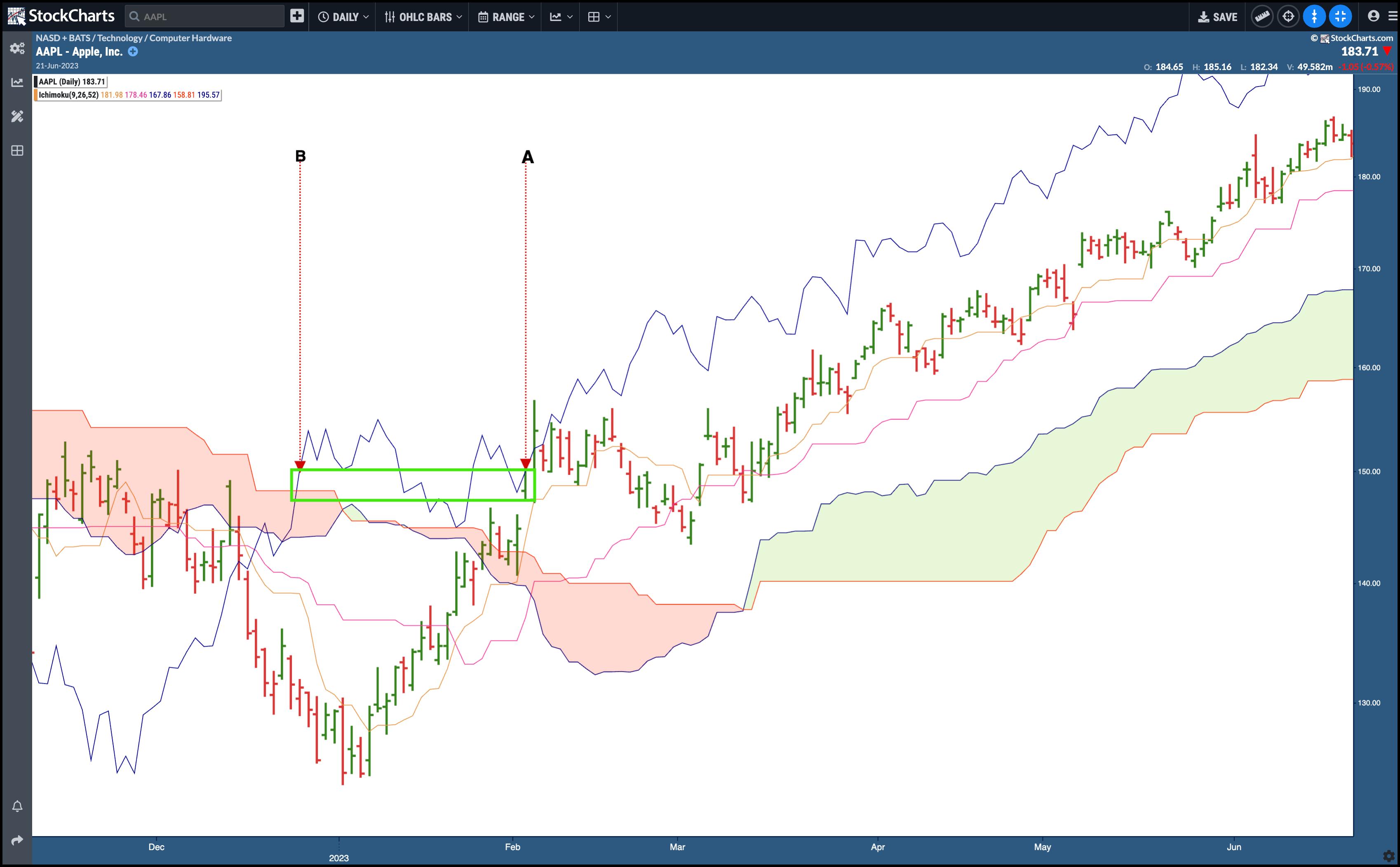

So, what might need been a greater commerce primarily based on a Chikou Span crossover? Let’s return to March 2023.

CHART 3. AAPL AND CHIKOU SPAN. The Chikou Span turned bullish earlier than most different indicators did.Chart supply: StockChartsACP. For instructional functions.

Originally of February 2023, the inventory value (level A) was nonetheless recovering from an unpleasant mixture of decline and consolidation. There have been a couple of layers of resistance overhead, and there weren’t many robust indications that costs have been about to make a break for the upside, save for one bullish sign: the Chikou Span (level B) crossed above value, the conversion and base strains, and the cloud itself.

What adopted was an uninterrupted seven-month uptrend, and the Chikou Span crossover was one of many earliest indications that costs have been getting revved as much as soar.

The Backside Line

The Ichimoku Kinko Hyo could be an efficient buying and selling instrument that gives a holistic market view by means of its 5 elements. Amongst these, the Chikou Span’s 26-day look-back characteristic is especially distinctive, because it offers retroactive insights that may, mockingly, be used to forecast future value motion. Whereas this “Lagging Span” operates with a 26-day delay, this does not diminish its anticipatory worth. As a substitute, it underscores the significance of retrospective evaluation, proving that typically a glance again can supply the clearest view ahead.

Karl Montevirgen is an expert freelance author who makes a speciality of finance, crypto markets, content material technique, and the humanities. Karl works with a number of organizations within the equities, futures, bodily metals, and blockchain industries. He holds FINRA Collection 3 and Collection 34 licenses along with a twin MFA in essential research/writing and music composition from the California Institute of the Arts.

Be taught Extra