Whereas the UAW strike continues, and the talk on how a lot it issues within the scheme of issues rages on, different wage tendencies are rising.

Amazon (AZMN) at present introduced it should rent about 250,000 logistics personnel for the vacation season at a wage of $20.50 per hour. The Amazon chart reveals a retracement to the July 6-motnh calendar vary excessive and the 50-DMA. Nevertheless, there’s a bearish divergence on our Actual Movement (momentum) indicator. This might imply value is weak to interrupt below the important thing help ranges or 135.30. It may additionally imply that if costs enhance from right here, momentum may enhance.

Nonetheless, this stays to be seen after at present’s announcement that might hit the underside line for Amazon, particularly if the vacation season will not be all that.

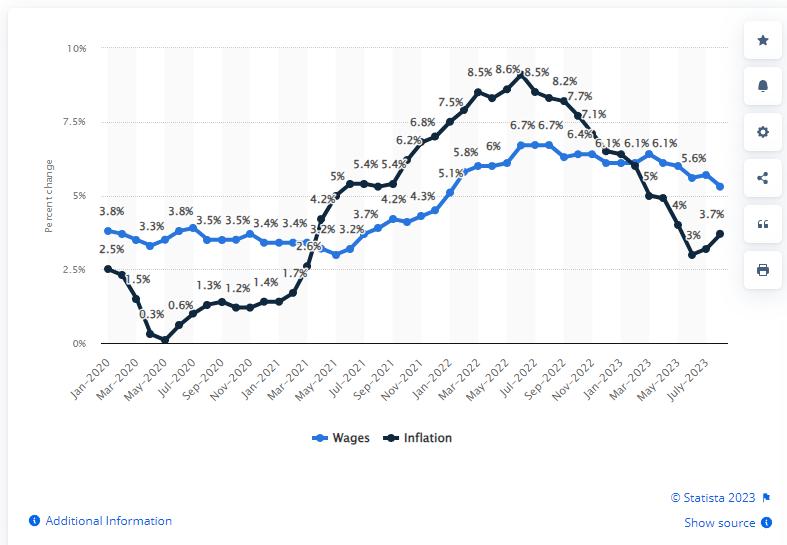

After 40 years of wages not maintaining with inflation or the price of residing, we began pondering: Is the subsequent wave of hyperinflation rising from wages, and never essentially simply from excessive meals and power costs?

To clarify:

Situation 1. Increasingly more employees demand greater pay, firms are pressured to conform. These firms should scale back their manufacturing thereby tightening provide. Demand stays sturdy with the added wages and stronger labor market; therefore, the price of items goes up.

Situation 2. Wages soften, as seen within the chart, since March 2023 and inflation doesn’t come down rather more (in actual fact it’s rising). Staff don’t get a better earnings. Staff start to depart their jobs, or quietly stop. Corporations should scale back their manufacturing, thereby tightening provide. Demand continues to outstrip provide (though not as a lot as in state of affairs 1) with the shortage of wage development; therefore the price of items goes up anyhow as a result of social unrest. Social unrest tends to create hoarding.

This can be a concept, in fact. This concept, although, relies on the pattern which began in the summertime and is constant into the autumn — demand for greater pay!

That is for academic functions solely. Buying and selling comes with danger.

For extra detailed buying and selling details about our blended fashions, instruments and dealer schooling programs, contact Rob Quinn, our Chief Technique Guide, to be taught extra.

Should you discover it troublesome to execute the MarketGauge methods or want to discover how we will do it for you, please e mail Ben Scheibe at Benny@MGAMLLC.com.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish talks Coinbase in this video from Enterprise First AM!

Mish Appears at some sectors from the financial household, oil, and danger in this look on Yahoo Finance!

Mish Covers oil, gold, gasoline and the greenback in this CMC Markets video.

In this look on Enterprise First AM, Mish explains why she’s recommending TEVA, an Israeli pharmaceutical firm outperforming the market-action plan.

Because the inventory market tries to shake off a gradual summer time, Mish joins Investing with IBD to clarify how she avoids evaluation paralysis utilizing the six market phases and the financial fashionable household. This version of the podcast takes a take a look at the warnings, the pockets of power, and the way to see the larger image.

Mish was the particular visitor in this version of Merchants Edge, hosted by Jim Iuorio and Bobby Iaccino!

On this Q3 version of StockCharts TV’s Charting Ahead 2023, Mish joins a panel run by David Keller and that includes Julius de Kempenaer (RRG Analysis & StockCharts.com) and Tom Bowley (EarningsBeats). On this unstructured dialog, the group shares notes and charts to focus on what they see as vital issues in at present’s market atmosphere.

Mish discusses AAPL within the wake of the iPhone 15 announcement on Enterprise First AM.

Mish explains the way to observe the numbers in oil, gasoline, gold, indices, and the greenback daytrading the CPI in this video from CMC Markets.

Mish talks commodities, and the way development may fall whereas uncooked supplies may run after CPI, on this look on BNN Bloomberg.

On this look on Fox Enterprise’ Making Cash with Charles Payne, Mish and Charles talk about the normalization of charges and the profit, plus shares/ETFs to purchase.

Mish chats about sugar, geopolitics, social unrest and inflation in this video from CNBC Asia.

Mish talks inflation that might result in recession on Singapore Breakfast Radio.

Coming Up:

September 20: Mario Nawfal Areas, 8am ET

September 21: Your Each day 5, StockCharts TV

September 22: Benzinga Prep Present

October 29-31: The Cash Present

- S&P 500 (SPY): 440 help, 458 resistance.

- Russell 2000 (IWM): 185 pivotal, 180 help.

- Dow (DIA): 347 pivotal, 340 help.

- Nasdaq (QQQ): 363 help, and over 375 seems to be higher.

- Regional banks (KRE): 44 pivotal, 42 help.

- Semiconductors (SMH): 150 pivotal, 145 help.

- Transportation (IYT): Must get again over 247 with 235 help.

- Biotechnology (IBB): Compression between 124-130.

- Retail (XRT): Weak particularly if this breaks down below 57, the 80-month transferring common.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Schooling

Mish Schneider serves as Director of Buying and selling Schooling at MarketGauge.com. For almost 20 years, MarketGauge.com has supplied monetary info and schooling to 1000’s of people, in addition to to massive monetary establishments and publications similar to Barron’s, Constancy, ILX Programs, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many high 50 monetary folks to observe on Twitter. In 2018, Mish was the winner of the High Inventory Decide of the 12 months for RealVision.