So simple as it might sound – obtain the bill, examine for correctness, pay the bill, shut the transaction – bill processing, normally, will not be a easy workflow.

Any delay or disruption on this course of can have a detrimental affect in your relationships with suppliers and hinder the well timed supply of companies, provides, and supplies. Almost 1 in 5 firms lose out on beneficial phrases and discounted charges resulting from delayed vendor funds attributable to ineffective bill processing.

Allow us to see how bill processing works, a number of the main challenges in doing it manually, and the way AP automation can streamline the complete course of.

What’s bill processing?

Bill processing or invoice processing is the entire gamut of operations related to the business-end (pun unintended) of buying merchandise/companies from a vendor.

Bill processing is the workflow adopted by the accounts payable workforce from the time it receives a provider bill. It encompasses all of the steps proper from receiving a vendor’s bill to recording the cost after acceptable checks & approvals.

An bill will be processed for cost solely as soon as it clears all of the bill processing steps.

Let’s take a look at the bill processing steps intimately:

The bill processing workflow: Find out how to course of invoices?

In medium and enormous sized firms, bill processing is a part of the accounts payable course of. Processing invoices effectively is vital not solely to prepare cash-flow but additionally for dealing with distributors/suppliers to make sure well timed procurement.

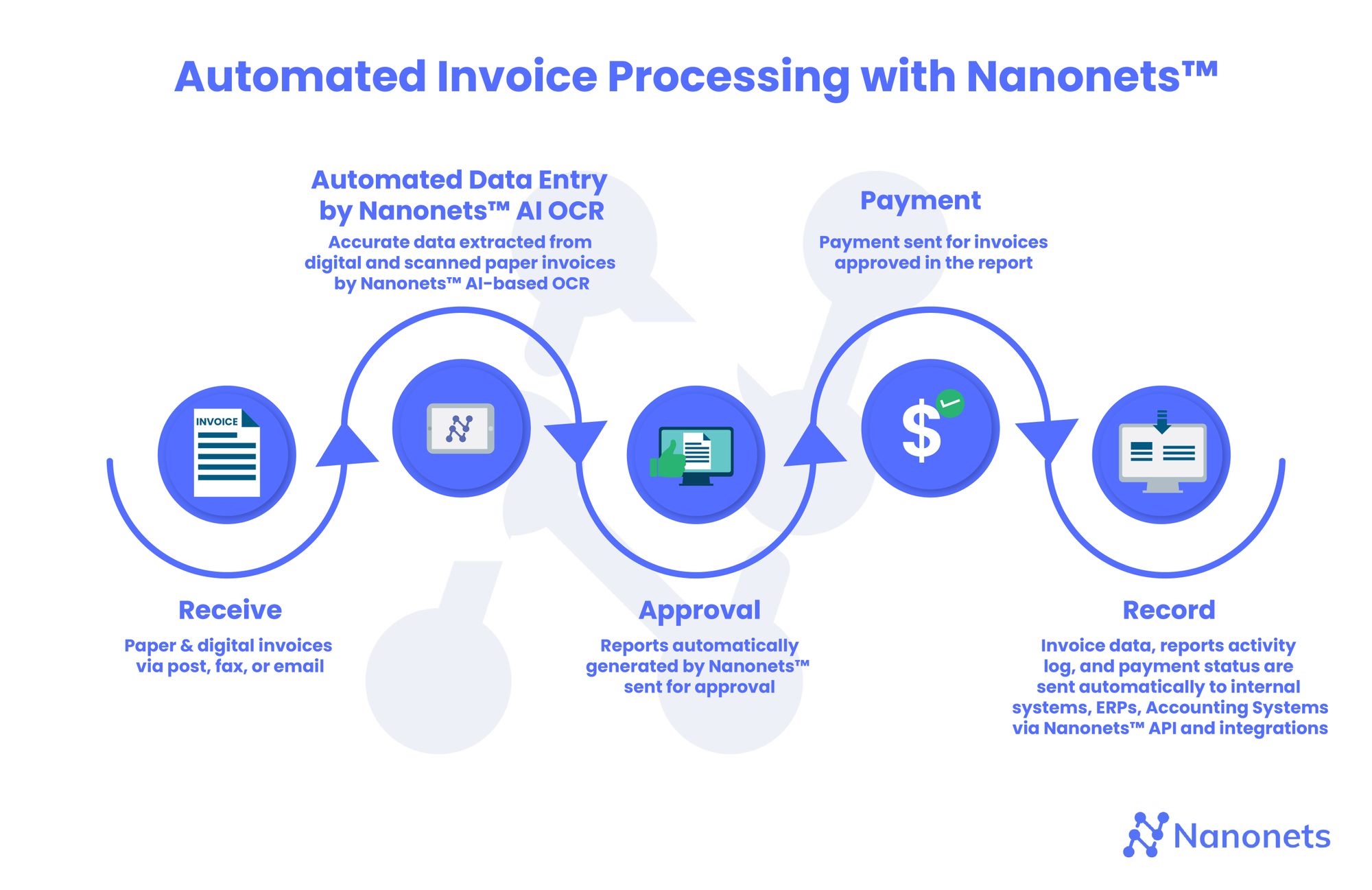

- Acquire and organise invoices despatched in through a number of channels: e-mail, publish and so on.

- Seize bill information, assign common ledger codes and match the bill information with supporting paperwork (POs or receipts).

- in case of discrepancies, the bill is returned to the seller.

- Ship invoices to approved approvers to approve or reject, primarily based on inner spend insurance policies.

- Arrange funds through wire switch, ACH or examine for the permitted invoices.

- Report the cost in your ERP or accounting software program.

Challenges in processing invoices manually

Bill processing can get fairly tedious. Listed here are a number of the most urgent challenges AP groups or finance personnel face whereas dealing with bill processing manually:

Missed or misplaced invoices

It is a downside when an organization offers with a number of distributors that ship in a number of invoices on a month-to-month foundation. The issue is exacerbated by the truth that invoices will be obtained by completely different personnel, in varied codecs, through a number of sources. Misplaced or missed invoices result in delayed funds, late cost charges, strained vendor relationships, delays in operation, and potential audit points.

Inaccurate or lacking information

An bill comprises vital information reminiscent of firm IDs, tax data, service/product provided, worth, supply standing and so on. Since invoices are available varied codecs, capturing & verifying all related bill information manually turns into fairly error-prone. Bill errors result in each financial and time losses.

Almost 40% of invoices include errors. And practically 1 / 4 of all invoices are flagged for exceptions that should be addressed by the accounts payable workforce. Errors in paper-based invoices are fairly costly to repair – the rectification of bill information can value $53.50 per bill on common!

Bill approval routing errors

Manually routing incoming invoices to particular stakeholders for approval can get very sophisticated. Particularly in case you take care of a number of distributors and have a big organisation. Even probably the most environment friendly AP specialist could make a mistake in manually routing an bill to the suitable approver/stakeholder. This “high-touch” state of affairs is especially hectic, particularly when the AP workforce should shut books periodically.

Unknown bill standing

Guide bill processing retains distributors just about at the hours of darkness, except they attain out personally for updates. Listed here are some frequent questions that distributors have as a result of lack of transparency: The place is my bill? Who has permitted it What extra does it want? When will the cost be processed?

Flagging duplicate invoices

A median AP at a medium scale organisation clerk processes anyplace between 600-800 invoices a month. Figuring out duplicate invoices or potential vendor fraud manually is near not possible!

Automated bill processing

Guide bill processing is a ache. Near 60% of AP personnel reportedly discover bill processing probably the most detested a part of their job. The automation of bill processing affords a transparent answer to most, if not all the issues related to this guide course of.

Nonetheless, automating most of the repetitive duties of the method can preserve time, lower your expenses, protect worker morale, and preserve good vendor relationships. Utterly touchless bill processing – mechanically processing invoices from receipt to closure, with out guide intervention – remains to be uncommon. A survey performed amongst personnel concerned in AP processes exhibits an awesome help for automating a majority of the guide duties.

AP processes which can be an excellent match for automation

A few of the bill processing steps that will profit from automation are:

- Bill receipt: On condition that varied codecs of invoices are obtained from completely different distributors, automated detection of the assorted related fields within the bill would assist in digitization of the bill and higher administration of knowledge. OCR instruments come in useful right here.

- Bill validation: It’s simple to arrange guidelines to examine for information integrity and completeness in invoices. Populating the assorted custom-made fields within the bill database can assist in detecting incomplete or lacking data.

- Three-way matching: Invoices are sometimes raised in response to a PO and are sometimes related to a receipt. These three paperwork can be related by a standard PO quantity. Automated matching of invoices, POs and receipts will hasten the validation course of and transfer the bill to the subsequent degree with out delays.

- Exception dealing with: Exceptions and edge instances usually are not unusual in bill administration. Edge instances might come up resulting from time zone adjustments, a number of recurring expenses, retrospective worth changes, and variable month lengths. Some software program, particularly these powered by AI, like Nanonets, can deal with these edge instances, whereas some require differing ranges of human intervention.

- The approval course of: Digital invoices will be moved alongside the administration hierarchy mechanically for approvals. The establishing of reminders can even assist in hastening the bill course of.

- Cost: Digital funds (wire-transfer and so on.) will be constructed into the software program to allow automated cost to the seller as soon as all approvals have been obtained.

- Analytics: Automation can allow evaluation and analyses of spend patterns and vendor relationships, which might assist in course corrections and productive enterprise choices. AI-based techniques would enable higher analytics with extra coaching with invoices.

Nanonets for clever bill processing

Nanonets is an AI-based AP automation software program that may streamline the bill processing for your corporation.

Knowledge will be captured error-free from quite a lot of bill file sorts. The AI engine of Nanonets will be educated with precise invoices, with out the necessity for coding, which makes it customizable to the corporate.

It additionally has built-in state-of-art algorithms and a robust infrastructure for multi-step approvals. The Nanonets bill processing software program will be built-in with different techniques such because the Mysql database, QuickBooks, or Salesforce and is platform agnostic. It’s correct and scalable, saves money and time to your Accounts Payable Bill processing workforce and enhances productiveness.

Takeaway

The automation of bill processing streamlines the acquisition course of, enhances transparency of the bill route, saves money and time, will increase worker productiveness, and improves vendor relationships. Bill stream automation permits human workers to focus on much less mundane, higher-value actions reminiscent of planning and strategizing. These can, in flip, result in improved general effectivity and profitability of the enterprise.