Many individuals are taken with shopping for Treasuries however they hesitate as a result of they don’t wish to complicate their taxes. That’s a reputable concern. How a lot shopping for Treasuries will complicate your taxes is dependent upon which Treasuries you purchase and the way you purchase them.

We go from the best to essentially the most sophisticated on this submit. It’s higher to learn to stroll earlier than you run once you aren’t accustomed to how taxes on Treasuries work.

No Worries in Tax-Advantaged Accounts

Shopping for Treasuries in a tax-advantaged account doesn’t have an effect on your taxes. These tax-advantaged accounts embrace office retirement accounts equivalent to 401k or 403b, Conventional IRA, Roth IRA, or HSA. You don’t pay tax once you purchase, maintain, or promote investments inside a tax-advantaged account. Taxes on withdrawals from these accounts rely solely on the account kind. It doesn’t matter what investments you purchase or how you purchase them in tax-advantaged accounts.

It makes no distinction by way of taxes whether or not you purchase Treasury Payments, Notes, or Bonds, whether or not you purchase common Treasuries or TIPS, whether or not you purchase a brand new concern by way of an public sale otherwise you purchase an present bond on the secondary market, or whether or not you maintain to maturity otherwise you promote earlier than maturity on the secondary market. Purchase or promote to your coronary heart’s content material once you’re in a tax-advantaged account. See How To Purchase Treasury Payments & Notes With out Payment at On-line Brokers and Methods to Purchase Treasury Payments & Notes On the Secondary Market.

Tax remedies are totally different solely once you purchase Treasuries outdoors tax-advantaged accounts.

Maintain Treasury Payments to Maturity

Taxes outdoors tax-advantaged accounts are additionally straightforward if you happen to solely purchase Treasury Payments and maintain them to maturity.

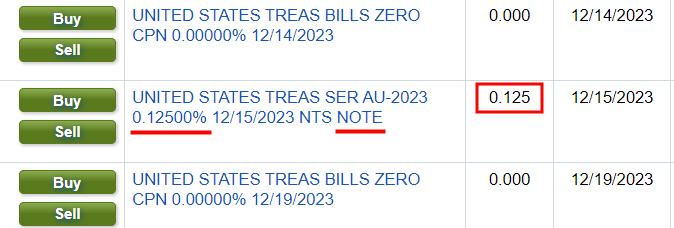

We’re speaking about strictly Treasury Payments right here. A Treasury Invoice has no “coupon,” which implies it doesn’t pay any curiosity whilst you maintain it. A Treasury be aware with a coupon that was issued a while in the past however now has lower than one 12 months left to maturity isn’t actually a Treasury Invoice. The primary and the third listings within the screenshot under are Treasury Payments. The center one isn’t.

Treasury Payments are offered at a reduction to the face worth. The distinction between the acquisition value and the face worth you obtain at maturity is your curiosity. It doesn’t matter whether or not you purchase Treasury Payments as a brand new concern at a Treasury public sale or on the secondary market so long as you maintain them to maturity. Taxes are easy as a result of the acquisition value is the one variable.

Your dealer will embrace the distinction between the acquisition value and the face worth as curiosity on a 1099-INT kind. For those who purchase at TreasuryDirect, make certain to obtain the 1099-INT kind from TreasuryDirect. The particular discipline on the 1099-INT kind says it’s exempt from state and native taxes. Your tax software program will calculate each federal and state taxes mechanically after you enter the 1099-INT kind.

By a Mutual Fund or an ETF

Shopping for Treasuries by way of a mutual fund or an ETF in a daily taxable brokerage account additionally doesn’t make your taxes too sophisticated. The dividends from the mutual fund or ETF can be included on a 1099-DIV kind. For those who promote shares in a mutual fund or an ETF for a capital acquire or loss, it will likely be included on a 1099-B kind.

These tax kinds aren’t new. You’ll have them once you purchase or promote different mutual funds or ETFs as effectively. Your tax software program will mechanically deal with the federal taxes with none extra steps.

Further Step for State Taxes

The additional wrinkle is in state taxes. You’ll have to get a report from the fund supervisor on what share of the fund’s earnings got here from Treasuries. That portion is exempt from state and native taxes. It takes an additional step but it surely’s not that tough. Please learn how to try this in State Tax-Exempt Treasury Curiosity from Mutual Funds and ETFs.

Maturity Decisions

Shopping for by way of a mutual fund or an ETF doesn’t imply that you simply’re shopping for long-term Treasuries. You could have many decisions in funds that spend money on totally different maturities. Select a fund that solely invests in short-term Treasuries if you happen to solely need quick maturities. Select a fund that solely invests in TIPS if you happen to solely need TIPS. The expense ratio could be very low in lots of funds and ETFs.

With so many decisions in funds and ETFs at a really low value, you actually don’t have to get into particular person Treasury notes and bonds until it’s essential to withdraw in a brief interval on a preset schedule otherwise you simply favor the psychological consolation. See Two Kinds of Bond Ladder: When to Exchange a Bond Fund or ETF.

Maintain New-Difficulty Treasury Notes and Bonds to Maturity

New-issue Treasury Notes and Bonds purchased at a Treasury public sale and held to maturity are a bit extra sophisticated however they’re nonetheless not too unhealthy by way of tax complexity.

Shopping for at a Treasury public sale doesn’t imply it’s essential to use TreasuryDirect. You should purchase new points at a Treasury public sale in your brokerage account by way of Constancy, Charles Schwab, Vanguard, or E*Commerce with no payment in anyway. See How To Purchase Treasury Notes With out Payment at On-line Brokers.

Keep away from Reopenings

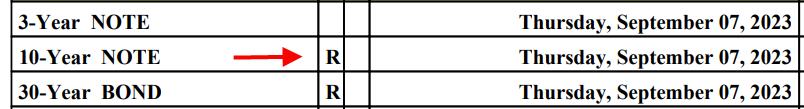

Not all Treasury Notes and Bonds offered at an public sale are true new points although. Some Treasury auctions are reopenings. A reopening occurs when the federal government is promoting extra portions of a bond that was already issued a while in the past. The tax therapy of shopping for a reopening is similar as shopping for on the secondary market, which is extra sophisticated than the tax therapy of shopping for a real new concern.

Reopenings are marked with the letter “R” in Treasury’s public sale schedule. Keep away from reopenings if you happen to’d wish to preserve your taxes easy.

The value of a real new concern from a Treasury public sale can be at a slight low cost to the face worth. You’ll deal with this small low cost when the bond matures. Treasury Notes and Bonds pay curiosity each six months. Your dealer will report these curiosity funds in the appropriate place on a 1099-INT kind. Your tax software program will mechanically calculate each federal and state taxes.

Accrued Curiosity

Often there’s zero accrued curiosity on a real new concern. If there may be any, it’s very small. The small accrued curiosity doesn’t present up on the 1099 kind. It’s solely within the 1099 complement. You’re allowed so as to add a unfavourable entry for the accrued curiosity to offset the coupon funds however as a result of it’s small, it’s not an enormous deal even if you happen to don’t know do it otherwise you merely neglect.

Maintain New-Difficulty TIPS to Maturity

TIPS provides a bit extra complexity than common Treasury Notes and Bonds as a result of TIPS receives each curiosity funds and inflation changes. It’s nonetheless not too unhealthy if you happen to stick with true new points (keep away from reopenings) and also you maintain them to maturity.

Along with the 1099-INT kind, the inflation adjustment can be on a 1099-OID kind. It’s one further kind however your tax software program is aware of deal with it.

Much like common Treasuries, the value of a real new concern TIPS from a Treasury public sale can be at a slight low cost to the face worth. You’ll deal with this small low cost when the bond matures.

A real new concern TIPS has solely a small quantity of accrued curiosity. You’ll discover it within the 1099 complement and add a unfavourable entry in your tax return to offset the curiosity. It’s not an enormous deal if you happen to can’t work out do it otherwise you merely neglect.

Shopping for a TIPS reopening at a Treasury public sale is similar as shopping for on the secondary market by way of taxes. It’s extra sophisticated than shopping for a real new concern.

Promote Treasury Payments Earlier than Maturity

Promoting Treasury Payments earlier than maturity provides one variable to the in any other case easy tax therapy of holding them to maturity. Now you’ll have each curiosity and a capital acquire or loss. Please be aware we’re nonetheless solely speaking about Treasury Payments that don’t have a coupon. It’s extra sophisticated if you happen to promote a Treasury be aware, bond, or TIPS that has a coupon.

The idea goes like this. For those who purchased $10,000 price of a 13-week Treasury Invoice for $9,865, you have been alleged to earn $135 in curiosity in 91 days by holding it to maturity. Suppose you offered it for $9,947 after holding it for 60 days, you do a linear proration to calculate the curiosity earned:

( $10,000 – $9,865 ) / 91 * 60 = $89

Your capital acquire or loss is the sale value minus the acquisition value minus the curiosity:

$9,947 – $9,865 – $89 = -$7

You earned $89 in curiosity and also you had a $7 capital loss once you offered this Treasury Invoice earlier than maturity.

You’ll must calculate this cut up between curiosity and capital acquire/loss your self in case your dealer doesn’t do it for you. In case your dealer studies the distinction between your buy value and your sale value as 100% curiosity or 100% capital acquire/loss on the 1099 kind, you’ll must right it in your tax return.

You could have this complexity from promoting earlier than maturity. You may keep away from it if you happen to maintain your Treasury Payments to maturity. For those who should promote one thing earlier than maturity although, promote Treasury Payments. It’s nonetheless easier than promoting bonds with a coupon earlier than maturity.

Purchase or Promote on the Secondary Market

The extra sophisticated tax therapy comes from shopping for or promoting Treasury notes or bonds with a coupon on the secondary market (together with shopping for a reopening by way of an public sale).

The present market fee will be fairly totally different from the coupon fee of an present bond. This ends in a big low cost or premium within the value. The massive low cost or premium makes taxes extra sophisticated. Shopping for or promoting on the secondary market typically includes paying or receiving a significant quantity of accrued curiosity, which it’s essential to additionally deal with on the tax return.

Methods to deal with these complexities is past the scope of this already lengthy submit. For those who might help it, for the sake of conserving your taxes easy in a taxable account, don’t purchase Treasury notes or bonds with a coupon on the secondary market, don’t purchase them in a reopening, and don’t promote them on the secondary market. Use the secondary market just for Treasury Payments. For those who should do these issues, do them in a tax-advantaged account.

***

Taxes on Treasuries get progressively extra sophisticated as you progress down the record. Be taught to stroll earlier than you run.

1. Do every thing in tax-advantaged accounts. No tax worries there.

2. Purchase some Treasury Payments and maintain them to maturity. That’s straightforward too.

3. Use a fund or an ETF. Not too unhealthy there.

4. If you need longer maturities in particular person Treasuries (together with TIPS) in a daily taxable account, solely purchase true new points in an public sale, keep away from reopenings, and maintain them to maturity.

5. Lastly, if you happen to should promote one thing earlier than maturity in a daily taxable account, solely promote Treasury Payments.

That’s so far as I’d go. Any extra issues aren’t price it to me.

Say No To Administration Charges

If you’re paying an advisor a share of your belongings, you might be paying 5-10x an excessive amount of. Learn to discover an impartial advisor, pay for recommendation, and solely the recommendation.